Is your business growth stalling? Sometimes, the signs are obvious, like when your numbers plateau. Other times, there are warning signs growth is about to stall or that it’s becoming more challenging to sustain your current rates. While this may be dismaying, the good news is that you’re likely catching the problem before it can cause serious harm. Addressing the issues and applying effective business growth strategies will help.

Below, we’ll walk you through warning signs and common issues that stall business growth so you can get back on track quickly.

Signs Your Small Business’s Growth is Stalling

The signs of growth stalling may be apparent in the late stages, but it isn’t always obvious at the start. Here’s what to look for.

Sales Efficiency is Declining

If your top salesperson is no longer meeting targets or is struggling to meet them, a growth plateau is on the horizon.

You Don’t Have a Single Source of Truth

If you don’t have solid customer data, including who’s visiting your website, clicking your emails, and expressing interest, or your team can’t access this information all in one place, diminished growth is inevitable.

Your Customers Are Leaving

If customers are leaving at high rates or as soon as you attract them, your growth will stall or decline.

Your Team is Leaving

Small businesses often have an “us against the world” mentality. Early employees live and breathe the company ethos. When those people start leaving, it’s a major sign that something damaging is happening internally that will likely result in slowed growth if it hasn’t already.

You Can’t Pay Your Bills on Time

Cash flow issues can be difficult to diagnose at times. For instance, if your business is growing, you’ll usually have a cash flow gap as expenses climb before revenue does. However, if you’re looking at your cash flow projections and don’t see a breakeven point in the near future, your growth is likely slowing.

9 Things That Could be Causing Your Business Growth to Plateau

Now that we’ve looked at some signs of slow business growth, let’s explore some of the most common causes and how to fix them.

1. Your Business Goals or Plan Are Lacking

A strong business plan includes everything from a detailed market analysis to your marketing strategy and financial planning information. If your business lacks this or actionable goals that correspond with the data, it’s impossible to know where you are or where you’re going.

Start by crafting a comprehensive business plan and have it reviewed by others you trust. If you’ve already taken care of this step, continue to update your business plan and goals at least once a year.

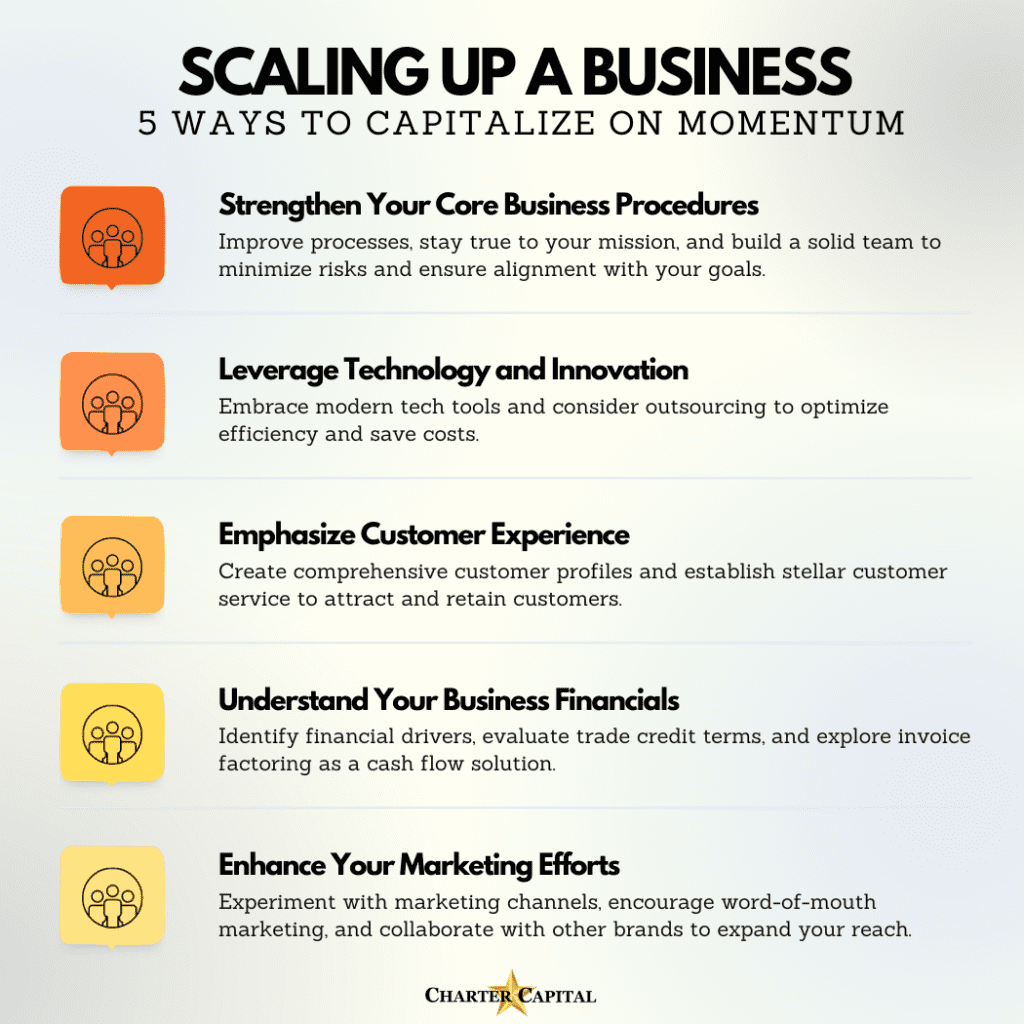

2. Your Business Operations or Processes Are Messy or Inefficient

Could you explain how critical business processes work to someone outside the business and have them understand it? Would they understand your usual customer flow or who handles what at each stage? If you’re unsure, consider your employee onboarding process. Do people quickly understand who is responsible for various activities or who to reach out to for assistance? If not, you find yourself giving lots of reminders, or your employee handbook is loaded with complex instructions, it’s time to improve your business operations and processes.

Look at each business process individually and how they come together.

- Are any processes redundant, and can they be eliminated? For instance, do you have employees rechecking work that your computers are doing?

- Can you automate any steps either using your current technology or by adopting new tech? For example, are your leads automatically receiving the right follow-ups?

- Can you outsource non-core tasks? For example, allowing your invoice factoring company to handle collections for you or outsourcing your marketing?

3. Teamwork is Lacking

Teamwork is linked to increased employee morale, productivity, profitability, and more. If your team works in silos or, worse, works against each other, your business cannot grow. Invest in team building to bring everyone together.

Effective team-building activities vary but include things like volunteer work, puzzle solving, and scavenger hunts. The key is to ensure everyone can participate, feels valued, and works together to achieve a common goal so that they bring this energy back to the business.

Additionally, you may need to make internal adjustments to break down silos. For instance, department heads should meet regularly. The resources and tools each department has available should be known to other departments and shared.

4. People Are Becoming or Setting Up Unnecessary Roadblocks

It’s often said that a company’s people are its greatest asset. This is generally true, but sometimes those same people become its greatest barrier to success.

For instance, it’s normal for department heads to fight for greater budgets. However, if certain team members can’t see the bigger picture and understand why the budget is allocated a certain way and brings animosity to the team as a result, their toxicity will be the downfall of the organization.

Sometimes, long-term employees are resistant to change as well. For instance, someone might be wary of how new technology will impact customer satisfaction. That’s a fair point, and it’s worth hearing the employee out to ensure customer satisfaction doesn’t falter, but if the concerns are unfounded and that person won’t get on board regardless, their negativity will spread.

Similar issues are seen with fatigued leadership or employees. After 50 hours of work, productivity falls, according to CNBC. If a person hits 70 hours, it’s as if they didn’t even work 15 of them. Moreover, these additional hours impact sleep, health, morale, and quality of life.

It’s up to you to ensure you and your team are set up for success and create a team that drives your business forward.

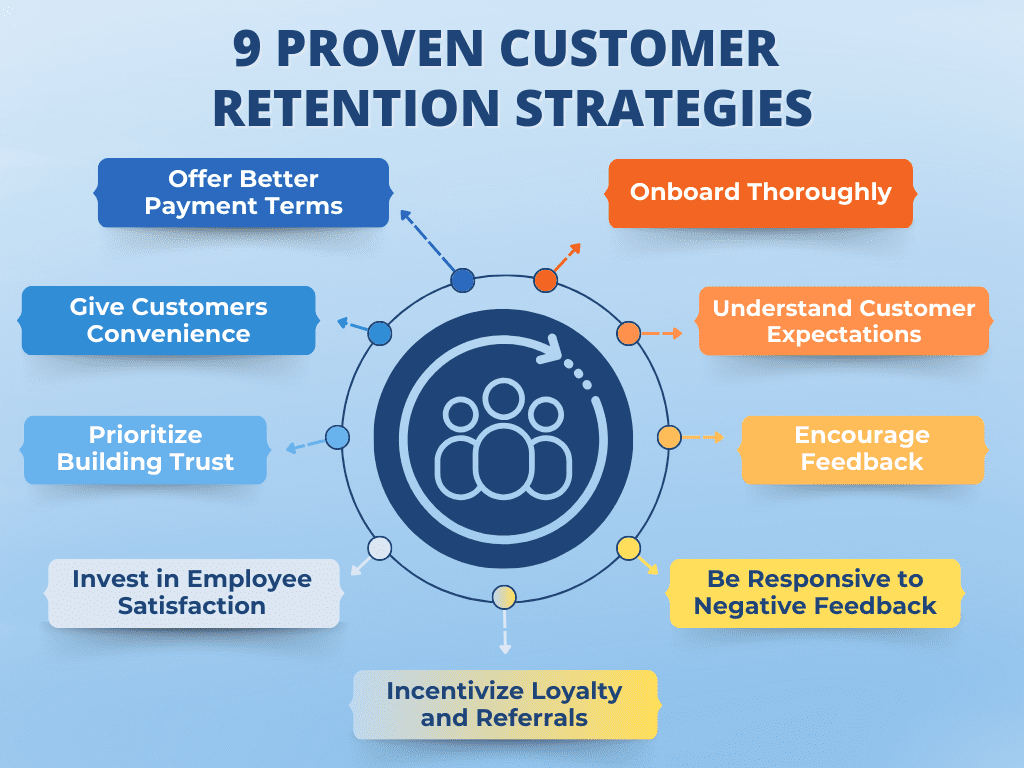

5. You’re Not Focusing on Customer Satisfaction and Retention

Customer retention does not get enough press. It’s up to 25 times more expensive to attract a new customer than to retain one, according to Harvard Business School (HBS). Their research also shows that boosting customer retention by just five percent can increase profit by up to 95 percent. Make customer retention a priority. A few tips to help include:

- Thoroughly onboarding new clients

- Understanding client expectations

- Request customer feedback and learn from it

- Incentivize loyalty and referrals

- Focus on delivering a top-notch customer experience

6. You’re Ignoring Your Brand Image or Online Presence

It’s estimated that 27 percent of small businesses don’t have a website, per PR Newswire. This, alone, is a huge loss of potential business, considering that 99 percent of consumers search for local businesses online, according to Statista. More than a third check multiple times each week.

Setting up a website is the major step in establishing your online presence. Still, it’s important to note that people are likely talking about your business regardless of whether you have a website. If you want to have any control over the narrative and your brand image, your business should be active across review sites and social media, too.

7. You’re Not Leveraging Data for Improvements in Strategy, Pricing, and Processes

Up to 73 percent of data goes unused, according to Forrester. This information could tell you more about what your customers want, how to operate more efficiently, pinpoint equipment malfunctions before a complete breakdown, and more.

Start by exploring the data sources you already have and exploring ways to leverage the data. You can also work with an operations specialist or data scientist to help you better understand the data you already have and identify trends that may help or how to extract more data.

8. You’re Starting to Blend in with Your Competitors Instead of Standing Out

Market competition is a challenge for most businesses. How you distinguish your brand, products, and services from others is a key determining factor in whether prospects choose you over them.

Refer to your business plan for information on competitive positioning and ensure you’re infusing each step of the customer journey with the data.

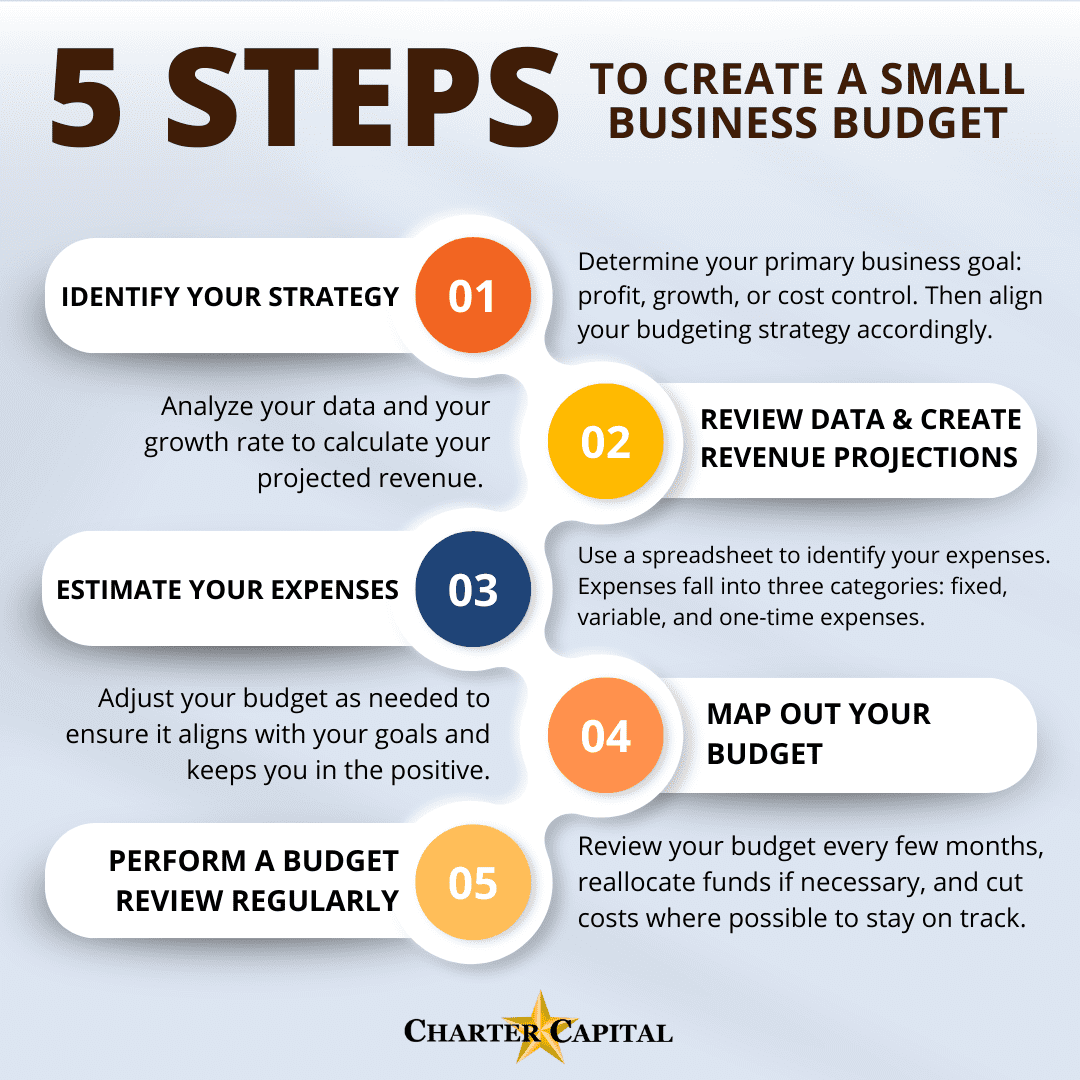

9. You’re Not Tracking and Managing Your Cash Flow

It’s estimated that 82 percent of business failures are tied to poor cash flow management, according to Forbes. Make sure you create accurate cash flow projections and develop a budget around business goals. If you find yourself short on cash due to growth, and it’s preventing you from seizing opportunities or covering expenses, ensure you have a backup funding source.

Identifying and Overcoming Growth Stalls in Business

Business growth often stalls due to a variety of factors like stagnation, valuation challenges, and a noticeable drop in revenue growth. Key steps to counteract this include diagnosing impending stalls through a comprehensive self-test, streamlining business operations, and identifying root causes. For renewed growth, business owners should reassess their growth strategy, focusing on innovation management, adapting to market changes, and exploring new markets. Enhancing product or service offerings, addressing external factors such as competitive challenges, and investing in new paths to success are crucial. Additionally, tackling issues like systemic inefficiency, and dysfunction in the innovation chain, and understanding customer acquisition dynamics can help prevent standstills. By taking a closer look at business operations, making necessary changes, and focusing on organizational strengths, businesses can effectively get back on track and ensure long-term success and profitability.

Get Your Business Growth Back on Track with Invoice Factoring

Invoice factoring unlocks cash trapped in your unpaid B2B invoices. Unlike a loan that gets paid back with interest and fees, factoring provides an immediate cash injection that your client pays off when they pay their invoice. This allows you to address cash flow shortfalls and shore up areas that are stalling your business growth without taking on debt. To learn more or get started, request a complimentary factoring quote.