How do factoring companies work? Factoring companies like Charter Capital purchase your unpaid invoices and provide immediate working capital (typically within 24 to 48 hours). Charter Capital advances up to 90 percent of the invoice value upfront, handles collections from your customers, and remits the remaining balance minus a competitive fee once the invoice is paid. With fast approvals, transparent pricing, and flexible terms, Charter Capital helps businesses bypass slow-paying clients and maintain steady cash flow without taking on debt.

An invoice factoring company, sometimes referred to as a factoring firm or a factor, is an entity that provides invoice factoring services. This financing service involves the factor purchasing your unpaid invoices and advancing you a percentage of the invoice amount upfront. Some of the best factoring companies also handle back-office processes like collections.

As a small business owner, you may face cash flow and revenue problems. These issues could be limiting your ability to fund and expand your business. A common business headache that could affect cash flow might be slow-paying customers that are halting your invoice processing procedures. They may extend your invoice processing times by 45, 60, or even 90 days, instead of paying you promptly. This puts you in a bind and leaves you looking for an answer to how you can get your money faster. So how can you get your clients to pay faster so that you can boost cash flow?

Well, you may not be able to get them to pay faster, but there is a way to get the cash quickly that your clients owe you in a convenient and effective way. It’s called invoice factoring. You may have heard of the term, but aren’t sure what it means. So, how does invoice factoring work? Invoice factoring is a business funding solution whereby a factoring company, like Charter Capital, will “buy” your invoices and accounts receivable from you. You get a percentage of their value upfront as a cash advance, and the remaining balance once all your clients have paid (minus a nominal factoring fee). You get immediate cash to fund your business, pay your employees, buy new equipment or supplies, or expand your firm. The factoring company is now responsible for collecting what had been your invoices. You’re relieved of the burden and the waiting. Instead of an outstanding invoice and a cash flow problem, you have the funds you need to be successful and grow.

For those wondering, the term “factoring” simply refers to the process of a third party – called a factor or factoring company – collecting on an invoice originally issued by someone else.

How Do Factoring Companies Differ from Banks or Traditional Lenders?

Factoring companies may seem like a new concept. Not at all. Factoring companies and invoice factoring have been around for hundreds of years! Small businesses are more likely to suffer from cash flow issues and, therefore, are more likely to require assistance. Invoice factoring is a proven small business funding method, and a trusted factoring company, like Charter Capital, can help businesses improve their cash flow without all the barriers they would face when taking out a traditional loan.

Not only is invoice factoring a quick, convenient, and effective business funding solution, it’s much easier and carries less risk than taking out a bank loan. With a bank loan, you must submit a business plan and tax statements, and then wait for the bank to make a decision. If the bank grants a loan, then you must make regular payments until the loan is repaid. With invoice factoring, the factoring company doesn’t ask for any of those things. Instead, you simply submit an invoice and receive immediate cash in return. Even better, you’ve nothing to repay later on.

Invoice factoring enables you to outsource your accounts receivable. The factoring company is now your accounts receivable department, available at a moment’s notice. So, rather than spending your time and effort trying to collect on invoices, you can get paid for them today and devote more time to focus on what’s really important – your business.

The factoring company will pay you cash immediately for your invoices. This means that you have the capital you need to achieve your goals. Your accounts payable problems are less stressful, and business funding is less of an issue. This gives you more financial freedom to expand and grow your business, as well as the ability to take advantage of early payment rewards and discounts from vendors. Invoice factoring is a great way to monitor customer service and detect problems early.

One of the most attractive benefits of using an invoice factoring company instead of a traditional lender, especially for small businesses, is that your business can still be approved if you have poor credit. Instead of focusing on your business or personal credit score, the factoring company will perform credit checks on your clients to determine how likely they are to pay their outstanding invoices.

To learn more about accounts receivable factoring and how it can help you solve cash flow problems and deliver efficient business funding answers, call Charter Capital today. Our knowledgeable representatives understand the funding needs of small businesses and the problems they face. Let us introduce you to the convenience and security of invoice factoring.

Get Business Funding Without Borrowing

Factoring Companies help to offer relief for one of the main reasons businesses fail – poor cash flow. Unfortunately, even successful businesses, at one time or another, have experienced cash flow problems.

Conventional wisdom dictates that you must borrow money to inject cash into a business. Don’t be fooled — banks are not the only places you can get business funding. A receivables factoring company can provide an available solution in which companies would not have to incur new debt.

Understanding the Invoice Factoring Process and its Benefits

The invoice factoring process is a straightforward way for businesses to improve cash flow without taking on new debt. Invoice factoring allows you to sell your unpaid invoices to a factoring company at a discount, providing immediate working capital. This method is not considered a loan, so it doesn’t impact your credit or add liabilities to your balance sheet. Instead, factoring allows you to access funds tied up in receivables quickly.

The factoring company specializes in evaluating the creditworthiness of your customers and advancing a significant portion of the invoice value upfront. Once your customers pay the factoring company directly, the remaining balance minus a small factoring fee is forwarded to you. This fee is minimal compared to the benefits of immediate cash flow. The best invoice factoring services offer flexible terms and personalized solutions. Whether you’re dealing with slow-paying customers or unexpected expenses, factoring can provide the financial support you need. Many businesses use invoice factoring to help stabilize operations and fund growth opportunities.

Maximizing Cash Flow with Invoice Factoring: A Smart Solution for Business Growth

For business owners grappling with cash flow issues caused by slow-paying customers, invoice factoring emerges as a strategic financing solution. Unlike traditional loans, factoring is a type of funding that hinges on the invoice’s value, allowing companies to access working capital without accumulating debt. When you qualify for invoice factoring, the factoring company pays a significant percentage of the invoice amount upfront, creating a positive cash flow.

Many businesses, especially B2B companies offering goods or services, use invoice factoring to transform outstanding invoices into quick access to funds. The process is straightforward: businesses sell their invoices to a third party – a factoring company – which then assumes the responsibility of collection. This shift not only expedites fund accessibility but also reduces the administrative burden on the business. Factoring agreements vary, but typically, many factoring companies offer recourse factoring, where the business remains liable for any unpaid invoices.

Questions about invoice factoring often arise, particularly regarding costs. The factoring cost usually involves a small percentage or fee per invoice, a figure subtracted from the total invoice amount. The total factoring fee hinges on various factors, like the volume of invoices and the creditworthiness of your clients. For a more detailed explanation of how much invoice factoring costs and what influences the rates, you can explore our factoring cost breakdown, which outlines the key pricing components small businesses should consider. While weighing the pros and cons of invoice factoring, it’s vital to consider the immediate benefits like improving your cash flow and gaining access to funds that are crucial for operations, expansions, or tackling cash flow issues caused by slow-paying customers.

Factoring also allows companies to conduct due diligence with minimal effort, as the factoring company will send reminders and handle collections, minus a factoring fee. This arrangement ensures business financing is more streamlined, enabling many businesses to focus on core operations rather than chasing payments. With invoice factoring, companies often find a reliable way to maintain a steady and healthy cash flow, which is vital for their growth and stability in competitive markets.

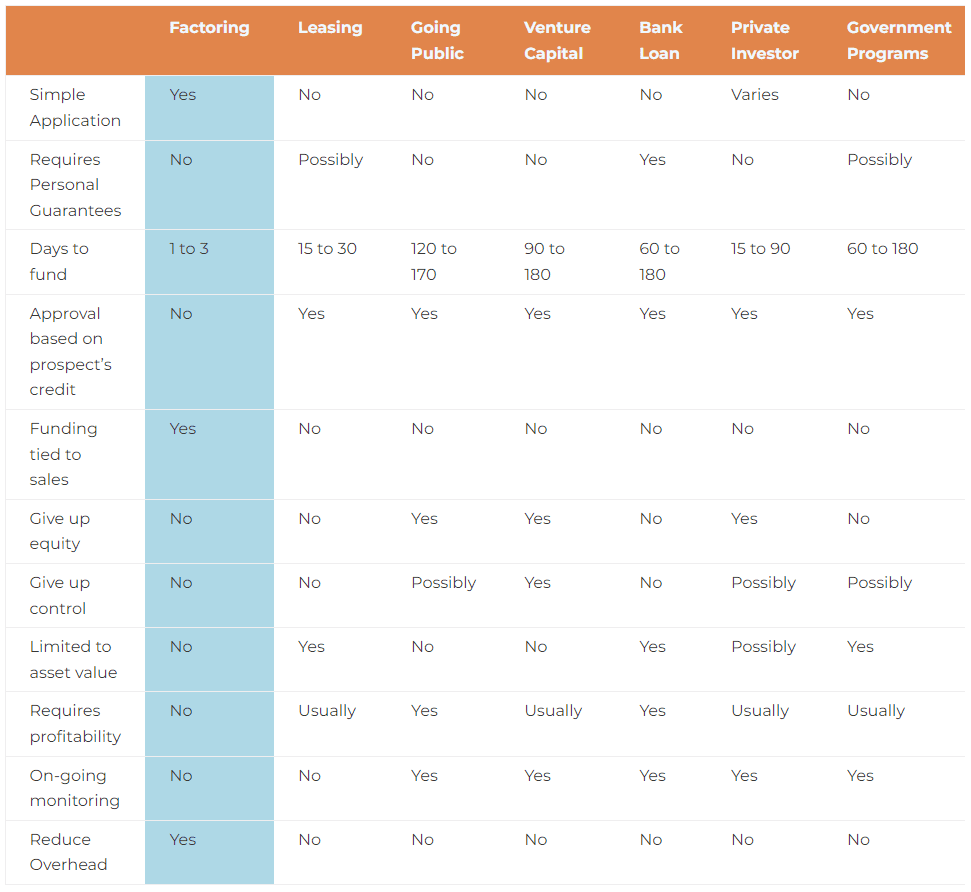

Factoring Compared with Other Types of Financing

Compared with other conventional types of loans, factoring stands out as an easy, affordable, and practical way to borrow money.

Factoring companies offer alternative financing for businesses of all sizes and stages. From start-ups to long-established companies, invoice factoring is a smart solution to combat cash flow crunches without taking on additional debt.

Invoice Factoring Explained

How does invoice factoring work? Simply, factoring is the process of selling accounts receivable to an investor instead of waiting to collect the money from the customer.

Factoring lenders have the financial backbone of many of America’s most successful businesses. Yet, ironically, invoice factoring is seldom taught in business schools, is rarely mentioned in business plans, and is relatively unknown to the majority of American business owners. Yet, it is a financial process that enables thousands of businesses to prosper and grow and frees up billions of dollars each year.

Interestingly, factoring has been around in many forms for thousands of years. Factoring companies are private investors who pay cash for the right to receive future payments on unpaid invoices. An unpaid receivable (invoice) has value. It is a debt your customer owes to your company and agrees to pay in the near future.

The Principles of Factoring

Although factoring companies deal exclusively with business-to-business transactions, a large percentage of retail businesses use a form of factoring that is familiar to us all. For example, MasterCard, Visa, and American Express all use a form of factoring in many retail transactions. In fact, these large consumer finance companies could be considered large factors of consumer paper.

Here’s an example: A customer makes a purchase at the store, and the customer pays with their credit card. The store gets paid almost immediately from the credit card company, even though the customer does not make a payment until 30 days later or more. For this service, the credit card company charges the store a fee (usually two to four percent of the sale).

Factoring companies can offer many benefits to cash-starved businesses. For example, rather than waiting 30 to 90 days or longer for payment on a product or service that has already been delivered, a business can factor (sell) its receivables for immediate funding at a small discount off the amount of the invoice. Payroll, marketing, equipment, and working capital are just a few of the business needs that can be met with this instant cash.

Factoring companies provide funding to manufacturers to replenish inventories and create more products for sale. You don’t have to wait until sales are paid earlier. Factoring not only helps manufacturers manage cash, but it can also be used by any commercial business.

Typically, most businesses that extend credit will have 10 to 20 percent of their annual sales tied up in accounts receivable at any given time. The fact is that you cannot pay utility bills or this week’s payroll with a customer’s invoice, but you can sell the invoice’s value for cash to meet those obligations. Factoring receivables is a simple and fast process. The factoring company buys the invoice at a discount, usually a few percentages off the face value of the invoice.

How Much Does Invoice Factoring Cost?

The cost of invoice factoring depends on a few factors, including the company itself. For an accurate view of how much a factoring company will charge, you will need to get a quote directly or inquire about a specific company’s factoring fee (discount fee). However, despite the differences in fees between companies that buy invoices, a factoring fee is a small price to pay for the benefits your company receives through the service.

Savvy entrepreneurs consider the factoring discount a small cost of doing business. A four-percent discount for a 30-day invoice is common. Compared with the problem of having enough cash to operate, a four-percent discount is negligible.

Look at it this way: There is not a lot of difference between a prompt-pay discount that many companies offer for invoices paid within terms and the discount fee charged by factoring companies. For many business owners, this discount fee is thought of the same way as a discounted sales price: It is simply the cost of generating cash flow, much like offering discounts on merchandise is the cost of generating sales.

Receivable factoring is a funding tool used by a variety of businesses, not just small or struggling ones. Many industries use factoring to reduce the overhead of their accounting department. Others use factoring companies to attain business funding that can be immediately put to work to expand marketing efforts or increase production.

Choosing the Right Factoring Company: Ensuring Business Efficiency and Growth

When considering whether to choose a factoring company for your business financing needs, understanding how factoring companies charge and the specific terms of a factoring contract is crucial. Invoice factoring may offer a viable alternative to a traditional business loan, particularly for businesses seeking swift access to working capital. Typically, a factoring company makes money by charging a fee for its services, which involves purchasing outstanding invoices from your customers and then assuming the responsibility for their collection.

Qualifying for factoring is generally more straightforward than for traditional loans. The main criteria focus on the creditworthiness of your customers rather than your business’s credit history. When invoices are sold to a factoring company, it pays the invoice amount, minus their fee, to the business. This process turns invoices into immediate working capital, providing a significant cash flow advantage.

Comparing invoice factoring vs a business loan reveals distinct benefits, especially regarding payment terms and the speed of accessing funds. With invoice factoring, you’re not incurring debt; instead, you’re leveraging the value of your invoices. This method can be particularly beneficial for businesses with long invoice payment terms or those that frequently issue invoices to a third party. The decision to use invoice factoring should be based on a thorough assessment of your business needs, the terms offered by the factoring company, and a clear understanding of how the factoring company assumes risk and provides payment to your business.

When you send invoices to a factoring company, it’s not just about getting faster payment; it’s also about transferring the administrative burden of chasing invoice payments and managing receivables. This shift allows business owners to focus more on core business activities, such as growth and development strategies, rather than on financial management. The right factoring arrangement can be a game-changer for businesses striving to optimize their cash flow and financial stability.

Why Are Factoring Companies Popular for Start-Ups?

For young companies that are growing rapidly, factoring may be a good option. Many businesses are able to get up and running faster by using invoice financing. This reduces the time it takes for cash flow to run smoothly. Factoring for small businesses eliminates the need to wait for customer payments and provides instant funding that allows start-ups to expand their services or produce more products. Small business factoring can help these companies make more money, even if they have to pay a discount.

What Industries do Factoring Companies Help?

Numerous types of businesses can benefit from working with a factoring company. Some industries that can benefit from the use of invoice factoring are:

- Transportation & Freight Industry (Including Freight Broker Factoring)

- Staffing Industry

- Oil & Gas Industry

- Manufacturing Industry

- Security Industry

- Service & Consulting Industry

Contact us today for an online quote or call our toll-free number at (855) 912-7671 to find out how easy it is to set up a Charter Capital FactorLine. One of our account representatives will be happy to assist you.