Security guard firms play a crucial role in maintaining safety and order, and their demand is ever-increasing in a modern world that requires armed and unarmed security services. However, managing cash flow can be challenging, especially when dealing with unpaid invoices and waiting for customers to pay. Invoice factoring offers a valuable solution for security guard companies looking to improve their financial stability. By factoring invoices, security guard firms can access immediate funds without the hurdles of traditional loans, allowing them to make payroll, hire professional security guards, and invest in growing their operations. Factoring works by allowing a security guard company to sell its invoices to a factoring company in exchange for quick cash, providing the financing needed to meet urgent expenses and fuel business growth. With flexible factoring options and competitive rates, security guard invoice factoring provides the cash flow solutions that businesses in the security industry need to thrive in a competitive market.

Security Companies Are Ideal Candidates for Security Factoring from Charter Capital

Whether you are a fully established security company or your business is just starting out, security factoring is a flexible financing method that can help you gain access to working capital without all the hurdles of a traditional loan. Factoring is a financial solution that gives security guard companies access to cash quickly by unlocking funds from unpaid invoices. Whether you’re navigating start-up costs or scaling to meet growing demand, factoring can help stabilize your operations without adding debt.

When it Comes to Funding Security Guard Companies, One Star Stands Behind You

- Accounts receivable funding made simple.

- Quick approval process.

- Customized terms.

- Immediate funding.

How Invoice Factoring Helps Security Companies Maintain Cash Flow

As one of the best security guard factoring companies, Charter Capital understands the unique financial challenges that security firms face. Managing cash flow can be difficult when waiting 30, 60, or even 90 days for clients to pay invoices. With invoice factoring for security companies, you can access immediate funding instead of waiting for customer payments, ensuring your business stays financially stable.

How Security Guard Factoring Helps Your Business

By factoring your invoices, you:

- Receive cash within 24 hours: No more waiting for slow-paying clients.

- Cover expenses: Manage payroll, equipment, and operating expenses with ease.

- Build relationships: Offer better payment terms to clients without hurting your own cash flow.

- Avoid debt: Factoring is not a loan, so there’s no repayment stress.

- Fuel business growth: Secure funding to hire staff, upgrade security technology, and accept larger contracts.

How Security Guard Factoring Supports Financial Stability & Growth

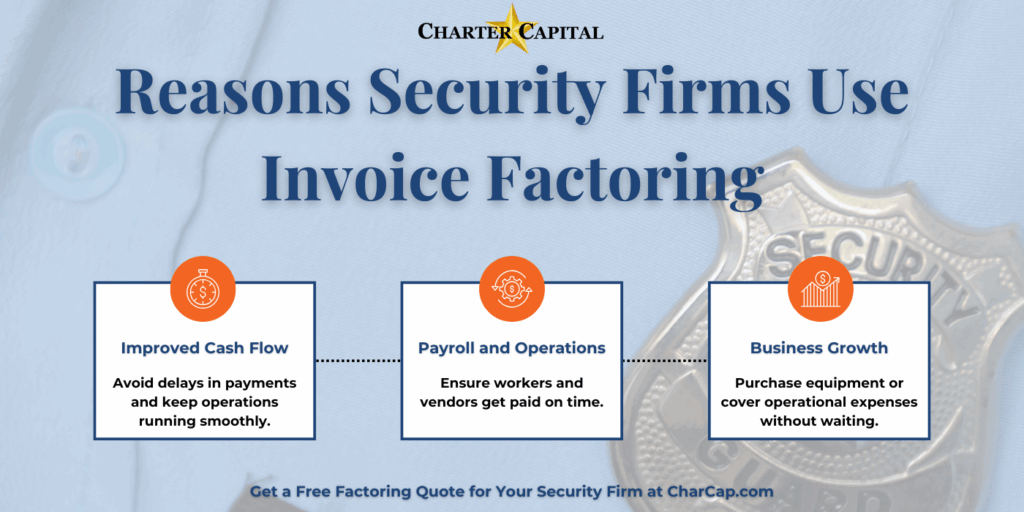

The demand for security guard services continues to grow, with more businesses and organizations relying on security companies to maintain safety. However, this increasing demand can also create cash flow bottlenecks, as firms wait for customer payments while trying to cover payroll and operational costs.

By choosing factoring for security guard companies, businesses can:

- Improve financial stability with quick access to capital for security guards.

- Meet payroll obligations without financial delays.

- Cover operating expenses and invest in security staffing and equipment upgrades.

Unlike traditional loans from a banker, factoring is an effective solution because it provides fast, flexible financing without long-term debt. With competitive factoring rates and transparent factoring fees, security guard firms can control costs while ensuring steady cash flow.

How Invoice Factoring Fuels Growth for Security Guard Businesses

Maintaining consistent cash flow is essential for growth for security guard businesses. Invoice factoring offers a practical financing solution by converting unpaid invoices into cash and ensuring companies can meet immediate financial obligations. Unlike traditional loans, factoring provides quick access to funds without adding long-term debt, making it especially useful for covering operational expenses, payroll, and equipment needs.

Factoring helps security guard agencies expand by enabling them to hire and train new security staff, invest in essential equipment, and accept new contracts without financial delays. By eliminating the wait for client payments, companies gain the flexibility to focus on growing their operations while maintaining stability in day-to-day activities.

With a transparent factoring fee structure and competitive rates, this financing method is accessible for both small companies and growing security firms. Whether your focus is on staffing, upgrading your services, or improving cash flow, factoring ensures your business remains agile in a competitive market. It’s a straightforward and reliable alternative to bank loans, offering the financial stability needed to thrive.

Understanding Factoring Rates and Fees for Security Guard Companies

When security guard companies use factoring, they gain immediate working capital without waiting for clients to pay their invoices. Understanding the full cost of factoring is essential to choosing the right factoring company. Factoring services provide quick access to capital, but knowing how rates are structured ensures your security business selects the best-fit funding solution.

How Factoring Rates Are Determined

Factoring fees are typically charged as a percentage of the invoice value, usually ranging from one to five percent. The total factoring cost depends on factors such as invoice volume, client creditworthiness, and whether a company opts for spot factoring or a long-term factoring agreement. Higher invoice amounts and strong-paying clients can result in lower invoice factoring rates.

Key Fees in Invoice Factoring for Security Guard Companies

- Discount Rate: The primary charge for factoring, deducted when invoices are funded.

- Processing Fees: Covers administrative work related to accounts receivable financing.

- Advance Rate Fees: Based on how much of the invoice is funded upfront.

- Early Termination Fees: If a company wants to exit a long-term contract.

Choosing the right factoring provider ensures that factoring gives security firms a cost-effective way to maintain smooth operations and support security guard companies as they scale. To compare rates and fees, businesses can request a factoring quote form for transparent pricing.

Payroll and Beyond: How Factoring Supports Security Guard Staffing Needs

For security guard businesses, one of the most pressing financial needs is ensuring timely payroll for a dependable workforce. Factoring for security guard companies directly addresses this need by converting outstanding invoices into readily available funds, allowing firms to pay their staff on time and even expand their security guard staffing. This financing option is a lifeline for security agencies experiencing cash flow bottlenecks, as it allows business owners to focus on expanding operations, hiring more guards, and addressing payroll demands without stress. Since factoring provides immediate cash based on outstanding invoices, it is particularly effective for growing security companies, allowing them to stay competitive and meet increasing service demands.

Beyond payroll, invoice funding for security guard companies supports broader business objectives, like purchasing necessary equipment, covering operational expenses, or investing in training for new security guards in a modern security environment. With this reliable funding option, business owners can confidently pursue new contracts and ensure they have the resources to meet client expectations. Compared to traditional loans, which might not suit companies with fluctuating revenue cycles, factoring offers security agencies the flexibility and stability they need to focus on growth, free from the burden of loan repayments or restrictive credit requirements.

With Our Security Guard Factoring Services, You Can Acquire Immediate Funding

- Add additional employees

- Settle outstanding tax obligations or other debt

- Negotiate discounts with suppliers

- Avoid bank NSF charges

- Fund acquisitions of other security companies

- Meet critical operating capital obligations like payroll

Personalized Service with a Dedicated Account Executive – you have one dedicated person and his or her assistant who handles your account. You don’t have to start over with a new person each time you call. We are seasoned professionals with decades of industry experience.

Very often, the cost of invoice factoring can be offset by the use of our back-office support staff, giving you the ability to add more guards or pursue new business opportunities, thus making your company more profitable.

Securing Success: Black Storm’s Remarkable $56k Growth with Charter Capital

How Do Invoice Factoring Services Work for Security Guard Companies?

In the competitive security guard industry, maintaining steady cash flow is essential for growth and operational stability. Security guard companies often struggle with unpredictable client payments, leading to delays in payroll, equipment purchases, and training new security guards.

Invoice factoring provides an effective financial solution by unlocking cash tied up in outstanding invoices, allowing security firms to meet financial obligations without taking on debt.

How Security Guard Invoice Factoring Works:

A reputable factoring partner advances a significant portion of the invoice value upfront, giving your firm the working capital needed for payroll, equipment purchases, and operational expenses. Security guard factoring provides flexible terms, allowing businesses to select tailored solutions that match their needs.

Instead of waiting for clients to pay, your business receives immediate cash flow by submitting outstanding invoices to a factoring firm. Once the customer pays the invoice, the remaining balance is released—minus a small factoring fee. Unlike traditional loans, accounts receivable factoring ensures financial stability without adding debt. Whether you’re a small security firm or a growing staffing company, factoring helps maintain uninterrupted cash flow, supporting scalability and operational growth. Additionally, some invoice factoring companies offer non-recourse factoring, meaning they assume the risk if a client fails to pay.

The Security Guard Factoring Process is Simple:

- You provide your service or product to your customers as you always have.

- You continue to bill your customers as you always have.

- You submit the outstanding accounts that you want to factor to Charter Capital along with our simple factor form.

- We wire your funds directly into your bank account for upfront payment. Typically, in less than 24 hours.

- We wait for your customer to pay us directly. When we receive payment, we notify you on the same day.

- You continue to grow your business, free from worrying about your cash flow.

Accelerate Your Business Growth with Security Company Factoring

Our tailored security factoring services can put cash in your hand the day you submit your invoices—no more waiting weeks or months for payment. There are no long-term contracts, and you control which invoices you factor. Whether you’re managing payroll or expanding operations, invoice factoring can help by turning your receivables into immediate working capital. It’s a factoring solution built for companies that need flexibility and speed. To learn more or kickstart the approval process, connect with us for a no-obligation funding estimate.