Ready to take charge of your finances by budgeting for business? It’s probably easier than you think. A typical business budget focuses on just two things: forecast earnings and planned expenditures. Yet, it goes a long way to creating accountability for an organization, allows you to make more strategic decisions, and helps you stay on track to meet your financial goals.

Unfortunately, nearly two-thirds of small businesses miss this crucial step, according to Small Business Trends. On this page, we’ll walk you through the process of business budget creation so you can cash in on all the advantages and help you align your budget with your business goals to achieve critical objectives faster.

Aligning Your Budget with Your Business Goals is Essential

A business budget can and should be about more than documenting your predicted income and expenses. Business budget planning, or the process of ensuring your budget supports your business goals, offers many benefits. It encourages the meticulous review of income sources, thereby facilitating an accurate calculation of the expected monthly income.

You Will Spot Wasteful Spending Quicker

A budget outlines all your business expenses. If you keep your objectives in mind as you review it, you’ll spot mismatches between how you plan to spend and how you should spend to reach your goals.

It’s Easier to Allocate Resources

A goal-aligned budget takes the guesswork out of where to apply funds. Cash goes to the items that support your goals.

You Will Have Money When You Need It

By design, your business budget puts money where you need it most. A good budget for business also includes a plan to save for unexpected expenses so that you can dip into it during an emergency.

Collaboration Between Departments Improves

The more involved your team is in the budgeting process, the more likely you are to break down silos and improve cooperation between department leaders. While you may initially face pushback from departments that want larger budgets, if they truly support the company and its objectives, they’ll quickly adapt to making the most of what they have and finding ways to share costs between departments.

Types of Business Budgets

There are several types of business budgets that you might use depending on your situation and goals.

Operating Budget

Operating budgets are usually created first and are leveraged by businesses of all sizes to improve operational efficiency. They’re short-term planning tools focusing on revenue, expenses, and profits. For instance, the owner of a staffing company might compare its operating budget every month to see if it’s overspending on supplies. This requires a clear understanding of budgeting principles to ensure effective business budget planning.

A typical operating budget contains your:

- Sales budget

- Production budget

- Purchases budget

- Direct materials budget

- Direct labor budget

- Manufacturing overhead budget (indirect labor, indirect materials, factory operating costs)

- Ending finished goods inventory budget

- Cost of goods sold budget

- Non-manufacturing budget (R&D, design, marketing, distribution, customer service, administrative)

Financial Budget

Financial budgets are often created after the operating budget is complete and are leveraged mainly by larger companies to improve financial efficiency. They’re long-term planning tools that focus on cash inflow and cash outflow. A large manufacturing company, for example, might review its financial budget to determine its value in the context of a merger.

A typical financial budget contains your:

- Capital budget

- Projected cash disbursement schedule

- Cash budget

- Pro-forma income statement

- Pro-forma balance sheet

- Pro-forma statement of cash flows

Master Budget

A master budget contains the operating and financial budgets and all their sub-budgets. For instance, a large oil and gas services company might use the master budget to help ensure managers of all departments are aligned.

Cash Flow Budget

Cash flow budgets can be created at any time and are leveraged by businesses of all sizes to ensure cash is being spent wisely. They’re short and long-term planning tools that focus on how and when cash flows in and out of the business during a specified period. This forms a key aspect of the monthly budget, so its accurate estimation is critical for the business’s financial health.

A trucking company, for example, might use its cash flow budget to determine if it can cover fuel, labor, and other expenses related to accepting a new load before it receives payment from the last load.

Static Budget

In the business budgeting process, static budgets are fixed and contain only items that don’t change regardless of revenue or sales volume. A security firm, for instance, might pay the same licensing and bonding costs each year or pay to rent storage space for equipment. The owner may monitor the static budget to identify overspending and static expenses that are no longer needed. It is also in this stage where unexpected costs can be predicted and cash set aside to avoid any disruption in the operations.

How to Create a Small Business Budget

In the context of business budgeting, certain types of business accounting software can make your budget for you. If you’re already using accounting software, check if it offers budgeting tools too. You can also pick up specialized budgeting software. If neither is available to you or you want to run the numbers yourself, create a detailed budget in a spreadsheet program such as Excel or Google Sheets.

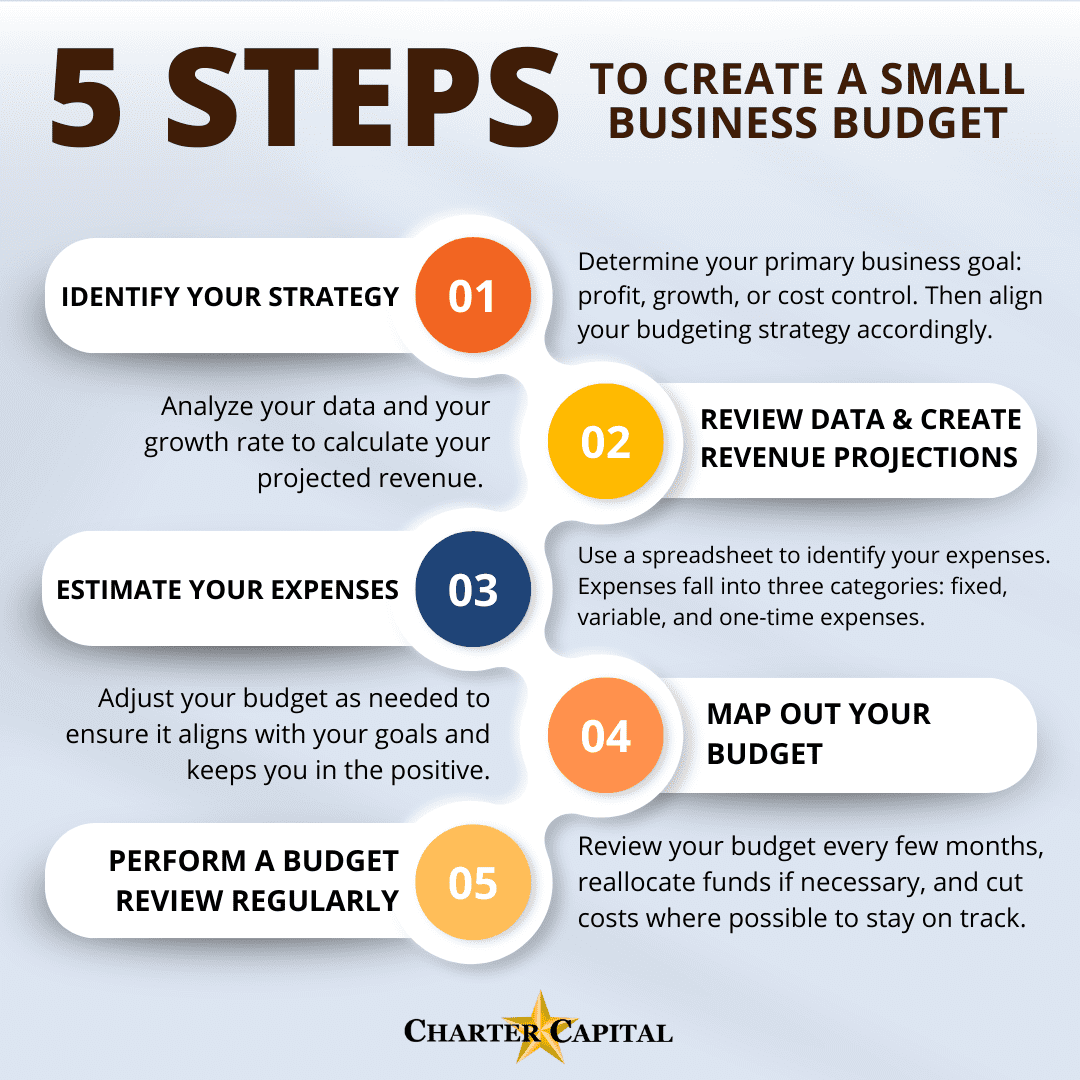

Identify Your Strategy

Depending on your company goals, you may want to build a budget based on profit, growth, or cost control. Although all three may be important to you, narrow your focus to the area that matters most and choose the strategy that aligns with it.

Budgeting for Profit

If your primary goal is to increase profit, you’ll start with determining your profit goal and then set the budget to support it. In this case, you’ll allocate more of your total budget to items that boost sales without increasing expenses. For instance, a professional services company, such as a business consultancy, might increase the budget for advertising or invest in a CRM to help the sales team automate processes and focus more on the leads that are most likely to convert.

Budgeting for Growth

If your primary goal is supporting business growth, you’ll build a budget to help close gaps in your systems, processes, and people. For example, a manufacturing company might budget for equipment that will allow them to boost productivity or earmark additional funds for employee training and development.

Budgeting for Cost Control

Sometimes businesses need to focus on cutting costs for a short period due to an economic downturn or temporary market shift. Think of this as more of a selective pruning, as opposed to cutting all possible costs like a business facing financial trouble might do. For instance, a freight broker might set a budget for cost control if a natural disaster impacts key areas it serves and no shipments are going in or out. In the short term, the freight broker might cut the marketing budget for that region or cut administrative costs due to the lighter workload.

Review Historical Data and Create Revenue Projections

If your business is established, explore historical data and your growth rate to calculate your projected revenue. Be sure to watch for seasonal shifts that also need to be reflected on your budget. If you don’t have historical data to draw from, research to see what businesses like yours typically earn.

Be conservative with these figures when in doubt. It’s better to have a surplus later than discover you’re short on cash because you didn’t meet your revenue targets.

Estimate Expenses

Expenses fall into one of three categories: fixed, variable, and one-time. It’s helpful to break these up on your spreadsheet so it’s easier to identify how your money is spent. Again, you can look at historical data to determine your estimated expenses or draft a list of everything you think you’ll pay for and research costs.

Fixed Expenses

Often referred to as “overhead,” fixed expenses don’t change from one period to the next, regardless of your sales volume. Examples include your rent or mortgage, insurance, and most loan payments. Traditional employee salaries also fit into this category, though hourly and project-based labor does not.

Variable Expenses

Sometimes referred to as the “cost of goods sold,” variable expenses increase with sales volume. Examples include raw materials, supplies, commissions, packaging, delivery, and labor.

One-Time Expenses

Things that you don’t pay for more than once or only pay for periodically are considered one-time expenses. Examples include buying major equipment, purchasing a competing business, the cost of relocating, and logo design.

Map it Out

If you’re drafting it in a spreadsheet, list each month as a column and place your yearly total as the final column. Then, create groups of rows for revenue, fixed expenses, variable expenses, and one-time expenses, with a totals row at the bottom.

You’ll likely see mismatches between your goals and anticipated expenses and may even see deficits in your totals. Adjust your budget as needed to ensure it aligns with your goals and keeps you in the positive.

Perform a Budget Review Regularly

Small businesses usually start creating their annual budgets about three or four months before the fiscal year begins. Give yourself time to work out the details and find something that fits your goals well. Once complete, review it every few months to ensure you’re on track, reallocate funds if needed, and cut costs if possible.

Additional Tips for Creating a Goal-Aligned Business Budget

Now that we’ve got the basics down let’s explore a few tips to make creating a budget easier or more effective.

Consider Your Long-Term Vision and Goals

While some budgets, like those used for cost control, are usually short-term, keep your business’s long-term goals in mind all the time. For example, if your long-term goal is to reach a particular growth stage by a specific date, then you need to consciously funnel cash into growth on an ongoing basis.

Prepare for Unexpected Expenses

Leave some room in your budget for unexpected expenses. Ideally, you’ll pay a savings account or similar on a recurring basis, just like any other expense, and grow your emergency fund over time.

Involve the Team

Businesses can become siloed as they grow. Involving leaders from each department breaks down those silos and opens up discussions about how the groups can best support one another to help the company reach its goals.

Bridge Gaps in Your Business Budget with Factoring

Your business may find itself short on cash at some point despite your best efforts with budgeting. This can happen when a company grows quickly, faces an unexpected expense, business slows, or customers pay slower than expected. Invoice factoring can help you bridge these cash flow gaps by providing instant payment for your B2B invoices. To learn more or get started, request a complimentary rate quote from Charter Capital.

- 6 Types of Business Insurance You Can’t Afford to Ignore - July 22, 2024

- Handling Payment Delays as a Government Contractor - June 24, 2024

- Quick Guide: Invoice Factoring for Security Companies - May 27, 2024