Small Business factoring is a powerful tool available to entrepreneurs. In addition to instantly boosting cash flow, hiring a factoring company as an outsourced accounts receivable department removes the burden of processing payments and more.

It is common for businesses to suffer cash flow shortages due to customers delaying their invoice payments by 45, 60, or 90 days (sometimes more). This is especially true for cost-intensive businesses in the transportation and service sectors, like trucking companies, staffing companies, security services, oilfield services, janitorial, and maintenance companies. Invoice factoring is an easy way for these businesses to solve cash flow problems caused by outstanding invoices.

Also known as accounts receivable factoring, invoice factoring services are also accessible for small, start-up businesses that may struggle to get a traditional loan or line of credit. This is because when Charter Capital purchases your invoices, we are more concerned with the creditworthiness of your customers than your credit or how long you have been in business.

The benefits of factoring companies for small businesses are extensive and usually more than offset the factoring fees. Also what you can consider is how much you get to keep.

“If spending a little makes you a lot, doesn’t it make sense?”

Running out of cash is not an option for any business to survive, and raising capital for a small business is difficult and time-consuming. You can get additional capital for your business in small amounts by using small business factoring, giving you quick access to cash without sacrificing equity or ownership.

Benefits of Using a Small Business Invoice Factoring Company

As a small business owner, you need steady cash flow for payroll, insurance, and day-to-day processes that keep your company running. Factoring for small businesses is a common financial tool that can give you fast access to working capital.

At Charter Capital, fast cash at competitive rates is only the start. You also get:

- Customized funding that fits your unique needs.

- Small business specialists who understand your unique challenges and goals.

- A true partner to help you overcome challenging financial obstacles and do the extra work to make factoring work for you.

- Dedicated account managers who care about your business.

- Fast response with no hurdles to jump over.

- We’ve earned a reputation for assisting small businesses with invoice factoring for more than 20 years. Long-term relationships and customer referrals demonstrate the positive results of our personalized service.

We’ve earned a reputation for assisting small businesses with invoice factoring for over 20 years. Long-term relationships and customer referrals demonstrate the positive results of our personalized service.

Small Business Factoring Can Be the Answer to Many Cash Flow Issues

It’s time-consuming to collect unpaid invoices. So, when a company finances its accounts receivable, they are getting their money faster and without the cost and effort of the collection process.

With small businesses, freeing up working capital through invoice financing can prove to be vital. The funds can be immediately invested into the business operation for new equipment, used to pay outstanding debt, or used toward payroll. It’s certainly more desirable than the alternative: chasing the customer for payment and deferring everything else while the money is tied up in unpaid invoices.

“Working capital in-hand today is better than dashed dreams tomorrow.”

What Types of Small Businesses Benefit Most from Invoice Factoring?

Invoice factoring is particularly beneficial for industries with long billing cycles and frequent cash flow challenges. Sectors like transportation, staffing, security, and maintenance often face delays of 30, 60, or even 90 days before clients pay their invoices. By selling these outstanding invoices to a factoring company at a discount, small businesses gain immediate access to working capital, enabling them to cover essential expenses without taking on debt. For instance, trucking companies struggling with delayed payments. In these cases, freight bill factoring provides a reliable cash flow solution by converting unpaid invoices into immediate working capital.

Freight brokers can also benefit from tailored solutions like freight broker factoring, which helps ensure timely carrier payments and smooth cash flow between shipments.

These industries typically encounter high costs and regular operational demands, making cash flow consistency essential. Factoring provides stability for these businesses, with options like recourse and non-recourse factoring to meet specific needs. For instance, non-recourse factoring transfers the risk of unpaid invoices to the factoring company, which can be especially advantageous for businesses concerned about payment reliability.

Moreover, small businesses with limited credit history or only a short time in business can access factoring, as it relies on the customer’s creditworthiness rather than the business’s own financial standing. This allows newer businesses to manage cash flow and invest in their growth, even in the face of delayed payments from clients.

Invoice Factoring: The Small Business Loan Alternative

Bank financing has been difficult for small business owners since the beginning. This is especially true today because most small businesses are just unable to qualify for traditional business loans. The requirements of getting financing from a traditional lender are a major barrier. The company must have substantial assets, years of profitability, and audited financial reports.

Many business owners don’t consider alternative financing options. They are unaware that there are alternatives to traditional bank loans and SBA loans. After being rejected, they often give up hope of ever getting financing. The truth is, these alternatives might be better for your company than traditional financing.

The biggest challenge for nearly all companies is their Accounts Receivable – the 30 to 60-day wait until the invoice is paid. During this waiting period, the accounts payable become due, and employees and suppliers need to be paid. This leads many businesses into a “cash flow crunch.” While this is fine for large, well-capitalized companies with adequate banking reserves, it is a significant challenge that many business owners face every day.

Understanding Factoring Fees and Rates: What Small Businesses Should Know

When small businesses use invoice factoring, understanding the factor rate and associated costs is crucial. Unlike traditional financing, factoring fees depend on invoice volume, customer payment history, and industry risk.

How Factor Rates and Discount Rates Work

A factor rate is the percentage charged by a factoring company to advance funds against unpaid invoices. It typically ranges from one to five percent per invoice, depending on risk factors and the terms of the factoring agreement. Some factoring companies offer tiered pricing, where higher invoice volumes result in lower rates. The discount rate refers to the total cost deducted from the invoice before the final payment is released.

Recourse vs. Non-Recourse Factoring Costs

The difference between invoice factoring options affects pricing. Recourse factoring offers lower rates but requires businesses to repurchase invoices when the customer doesn’t pay. Non-recourse factoring shifts the risk to the factoring company, leading to higher fees due to increased liability.

Choosing the Best Factoring Structure

Since many factoring companies structure fees differently, reviewing contract terms is essential. The best factoring choice depends on cash flow needs and risk tolerance. Understanding these costs ensures businesses make informed decisions while maintaining steady cash flow.

Growth for Small Businesses Financing

For small business financing, partnering with an invoice factoring company is invaluable for entrepreneurs seeking to overcome their cash flow challenges. By transforming outstanding invoices into immediate working capital, small business invoice factoring stands out as a method designed to strengthen financial stability and growth for small businesses. Unlike traditional business loans, invoice factoring for small businesses offers a straightforward, efficient solution to managing cash flow by providing access to funds tied up in unpaid invoices. This financial strategy accelerates business operations and allows small business owners to focus on future growth rather than being weighed down by the time-consuming process of chasing payments. Factoring companies work closely with businesses, offering factoring services that align with unique business needs and objectives. From improving the business’s credit to enabling strategic investments, the best invoice factoring companies provide a foundation for sustainable growth and success, making invoice factoring a fit for your business’s evolving demands.

Strategic Uses for Small Business Factoring Funds

Beyond meeting payroll and covering operational costs, factoring funds allow small business owners to invest in growth areas like marketing, technology, and equipment. Factoring companies typically advance a substantial percentage of the invoice value upfront, with the remainder, minus a factoring fee, paid once the customer settles the invoice. This structure provides businesses with the capital needed for immediate improvements that support long-term success.

One strategic advantage of factoring is that it doesn’t add debt to the business’s balance sheet, preserving its capacity to seek other financing in the future. Businesses can use factoring to improve cash flow without impacting their business credit, which can enhance their financial standing for future financing options.

Additionally, many businesses use factoring to reinvest in service upgrades, product enhancements, or competitive improvements, such as expanding fleets or hiring skilled staff. Through careful allocation of factoring funds, small businesses can strengthen their market position and accelerate growth.

Increasing Small Business Potential with Invoice Factoring for Small Businesses

Small businesses are continuously seeking financing options to stay ahead. Invoice factoring companies offer hope, presenting an alternative to the traditional business loan model. Working with a factoring company ensures capital and empowers business owners to leverage their accounts receivable for growth opportunities. Invoice factoring allows small business owners to secure the necessary resources to expand operations, invest in marketing efforts, and improve their product offerings.

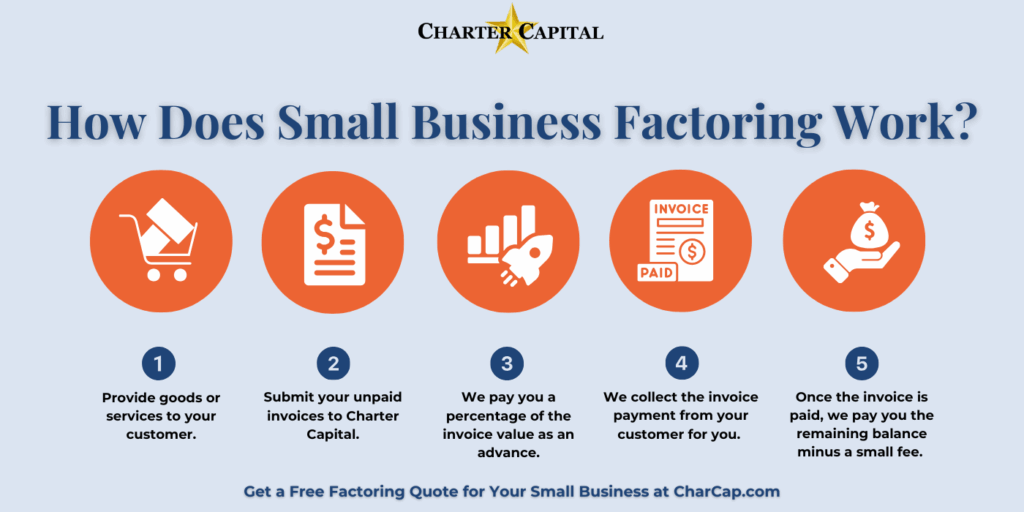

How Does Small Business Factoring Work?

There are many ways to maintain a positive cash flow when growing your business and dealing with Accounts Receivable issues. One popular way to increase cash flow is Invoice Factoring. Invoice Factoring (also known as Accounts Receivable Financing) is the practice of selling your accounts receivable (invoices) at a discount to another company. You get the money from the company that you sold your accounts receivable to, and they become responsible for collecting the outstanding invoice amount.

The reason many businesses make this move is to ensure the continuous flow of cash to the business. Essentially, businesses that use invoice factoring focus on having most of the money now rather than all of it later. It can take time to collect on an invoice, so when a company finances its accounts receivable, it gets its money faster and without the hassle of the collection process.

It is especially important for small businesses to have working capital available through small business factoring. You can use the money to purchase new equipment, pay your bills, or for payroll. The alternative is to chase down the customer and pay the invoice, deferring all other activities while the money is being collected.

With small business factoring, you can meet your business expenses without worrying about when your clients will pay. It’s the business loan alternative that provides businesses with predictable cash flow and positions them for growth.