Starting a business is not for the faint of heart. One in five fails within the first year and half close within five years, Investopedia reports. Less than one-third make it to ten years. While these statistics may seem grim, most of these closures can be directly attributed to just a few common startup mistakes. On this page, we’ll walk you through some entrepreneurial challenges you’ll likely face in the early years and how to avoid the business founding mistakes that trip most people up.

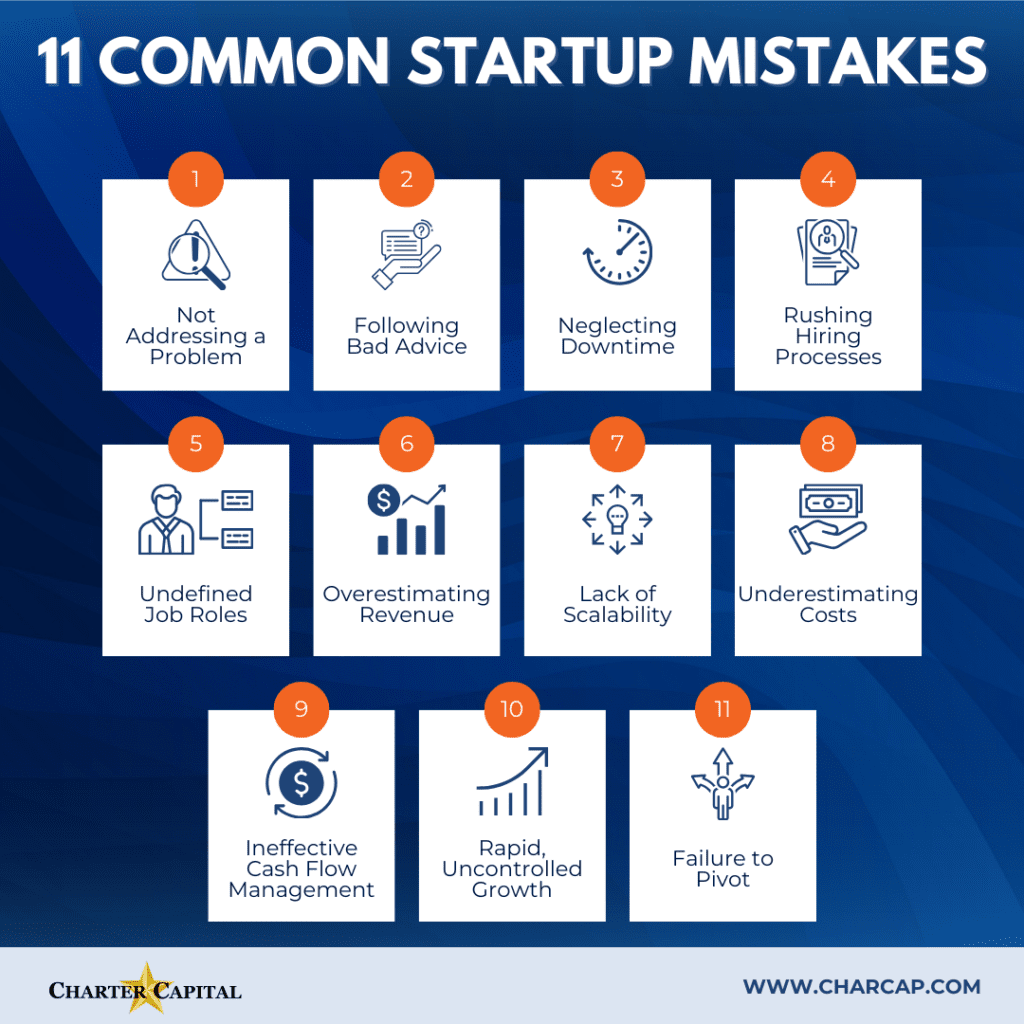

1. Having a Product or Service That Doesn’t Solve a Problem

You may see the value in what you’re offering, but do others? Often, people close to a business don’t realize there’s no market for their product or service. Think critically about what happens when you tell others unfamiliar with your company what you do.

- Do people seem confused by the concept?

- Do people stay mostly quiet or clam up beyond giving basic congratulatory messages?

- Do you spend a lot of time explaining what you do or how it works?

If so, there might not be a market for your product or service. Consider doing more market research to see if there is a way you can adjust your offering to fill an unmet need.

2. Following Bad Advice

Everyone will have advice on how you should run your company. However, most people will have no experience running a successful startup. Skip the advice from well-meaning friends and family.

It may be helpful to connect with other entrepreneurs but remember that they’re also experiencing a large learning curve. Even if someone has found something that works for them, that doesn’t mean their solution is viable in the long run or isn’t creating more problems they haven’t discovered yet. Take this advice with a grain of salt.

If you’re stuck, defer to an expert. That may mean bringing in finance pros, tax specialists, lawyers, consultants, and more. Also, keep a pulse on your customers. While they may not be able to help you run a profitable business, they are experts in knowing what they want and need.

3. Not Scheduling Downtime

The average CEO works close to 12 hours per day, according to Harvard Business Review. In the tech industry, CEOs clock 14-hour days, First Round reports. People can’t sustain this kind of momentum in the long run. It impacts stress and sleep, which often leads to needless mistakes and burnout.

You may be thinking that the extra hours are essential. You have work to get done. However, the hard truth is that you probably aren’t getting more done when you put in extra hours. Productivity declines sharply at the 50-hour mark. People who work 70 hours per week are no more productive than they would have been if they’d worked 55 hours, CNBC reports.

Schedule your days in a way that ensures you get time away to rest and rejuvenate. Your performance, and therefore likely business performance, will be better as a result.

4. Hiring Too Fast

First-time founders are usually eager to begin hiring. Bringing in extra bodies can help your business grow and allow you to delegate more tasks. However, when businesses hire too fast, they often wind up with people problems such as:

- Employees who aren’t a good fit for their role.

- A lack of culture fit.

- Slow or poor onboarding and training.

- More employees than needed.

Bring on newcomers strategically. Evaluate outsourcing specific tasks or processes before creating full-time roles. When you do hire, choose the roles you fill carefully and try to resist the urge to hire someone simply because they’ve worked at a startup before. Evaluate each candidate’s skills, knowledge, and culture fit before moving forward.

5. Not Defining Job Roles

You’ve probably seen job descriptions, or maybe even written ones, that ask for a “rockstar” or “Jack of all trades.” This tends to be code for: “I want someone who can do everything.” Unfortunately, nobody is good at everything, and those who try to do it all for you will wind up burning out.

Instead, create clearly defined job roles. This will make it easier to find the right person for each role, ensure their deliverables are understood, and help you measure their success in the role.

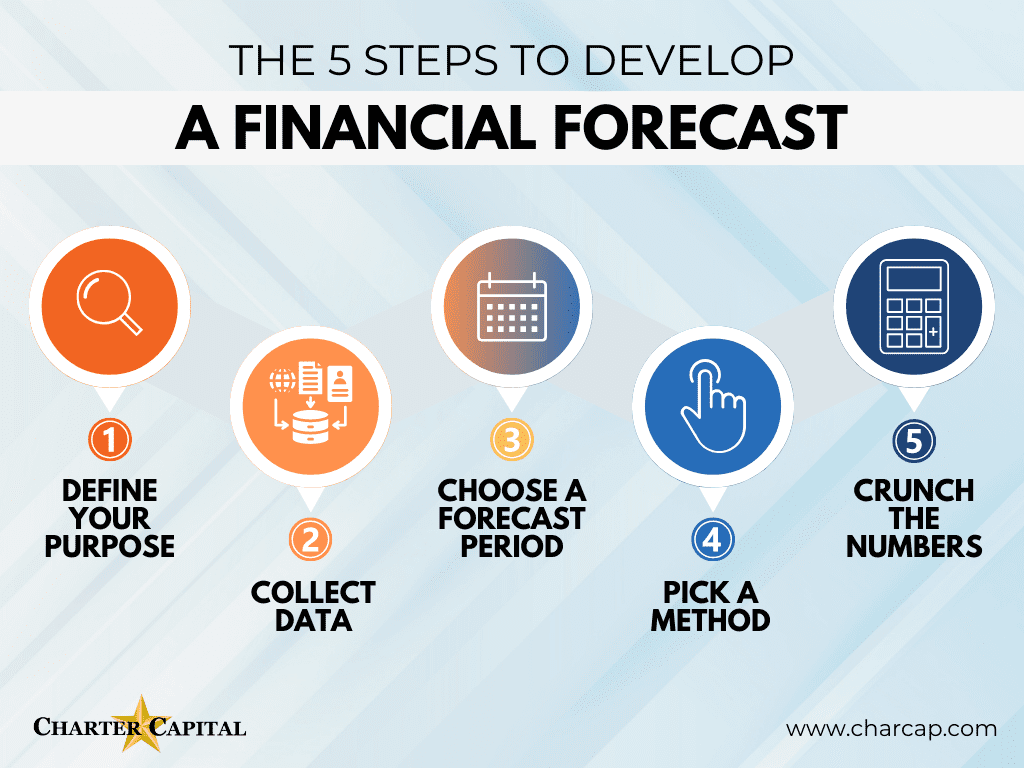

6. Overestimating Revenue

It isn’t easy to gauge how much money a business will make when it’s just getting started. While you can leverage market data and compare similar businesses, you’re still using figures generated by established companies to create your projections. Generating brand awareness and developing an audience takes a considerable amount of time. During this time, you’re also developing processes and building the infrastructure to do business, which may impact how much work you can take on and the resources you have to apply to growth initiatives.

Expect a very slow start and give your business time to ramp up. If you’re unsure what this looks like for your industry or business, connect with a consultant who does.

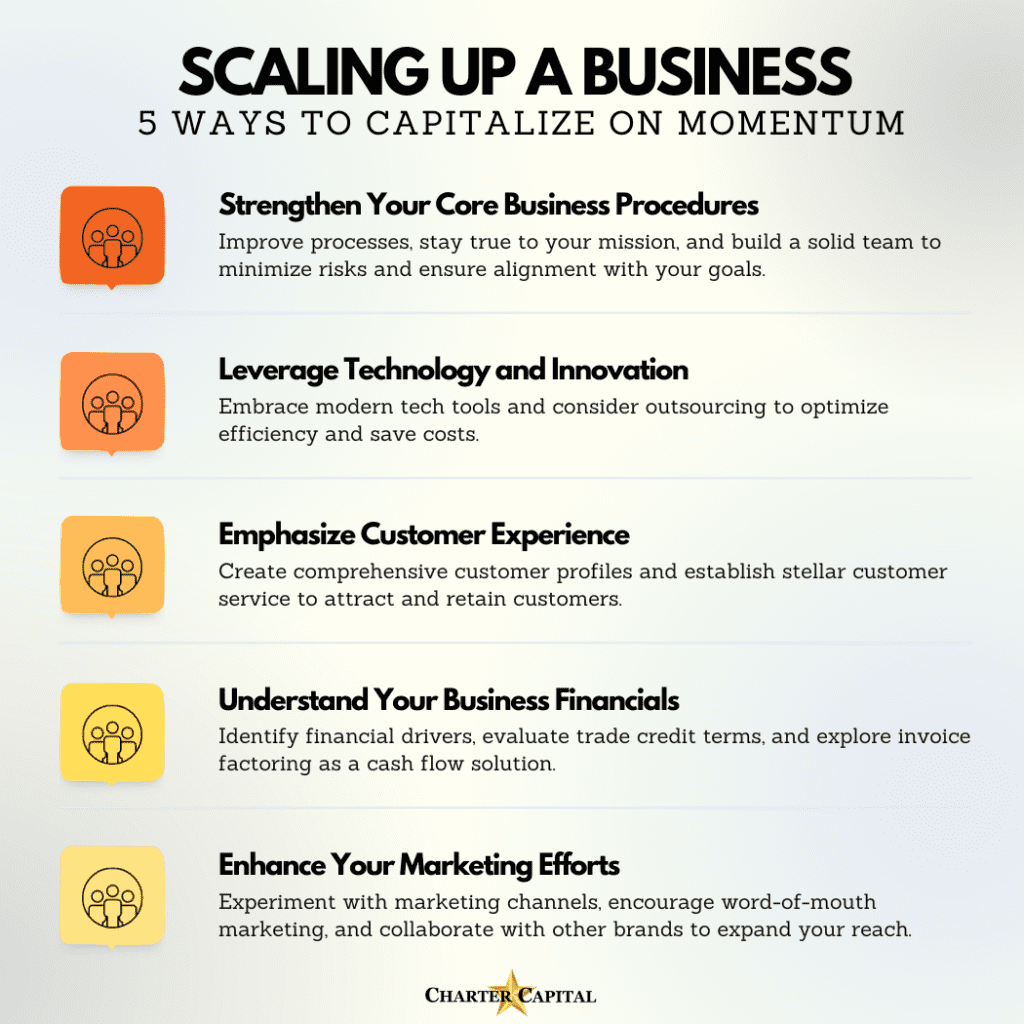

7. Forgetting to Build Scalability into Processes

Startups tend to develop processes as they go. For instance, you may be managing several departments as a founder. That means you’ve probably set up all emails and online lead generation forms to forward directly into your inbox. You process these things using your preferred methodology, and then they “evaporate.” There’s no trail to show what you’ve done. All information is stored in your head. Nobody but you knows what happened or what else the person might need. This is common with most business processes in a startup. It creates major headaches as the business grows and more team members are brought in.

As you develop your internal procedures, consider how things will need to be handled as you grow. Try to develop processes that will scale with you and get the systems in place early. That means you’ll probably need tools like customer relationship management (CRM) and accounting software. As an added benefit, you can use these tools to begin automating many of your processes now. It’ll save you time and allow you to focus on growing your business.

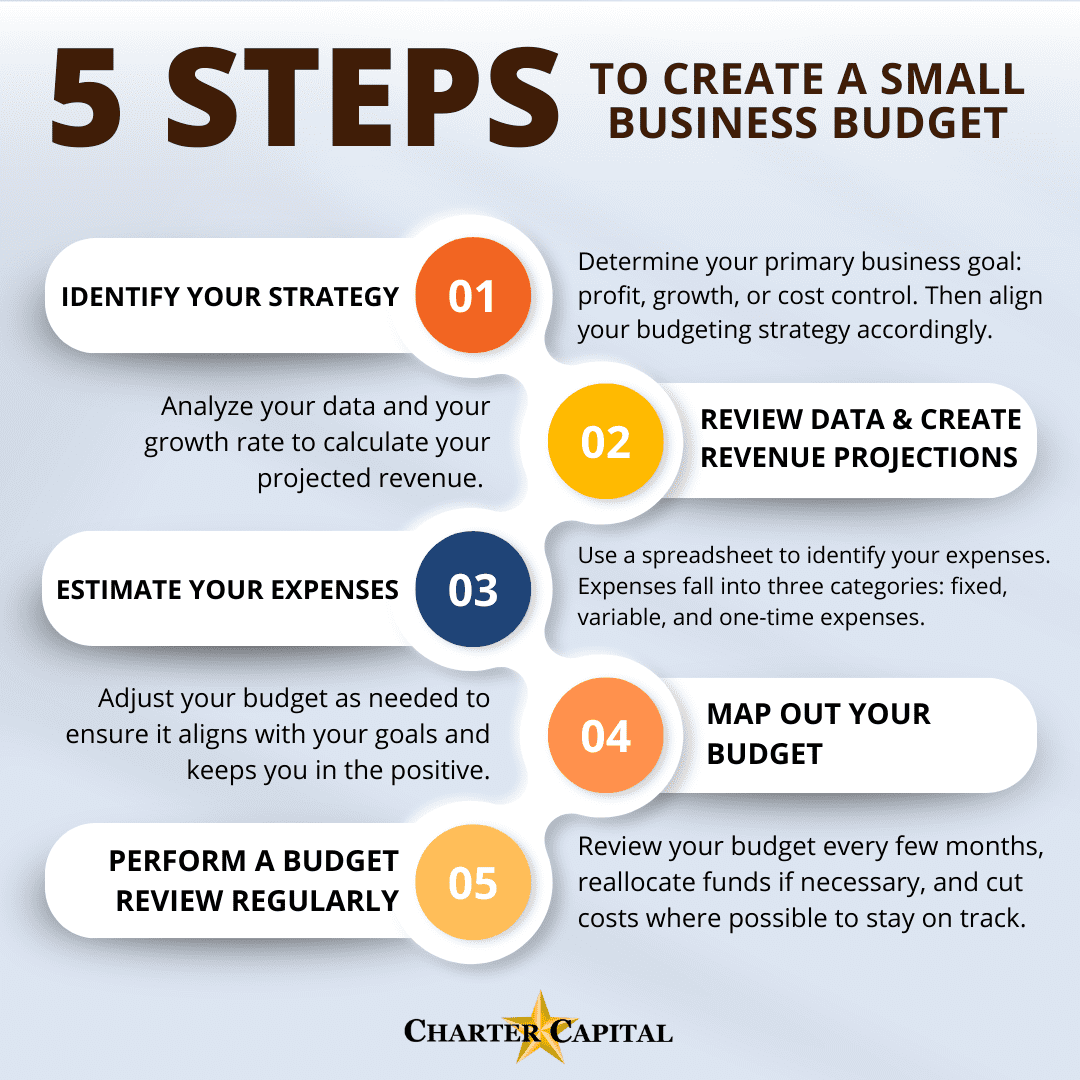

8. Underestimating Costs

Remember when you moved into your own home for the first time? There were so many things to buy. The costs, from linens to cleaning supplies and paying utilities, really added up. It’s the same way when you’re starting a business.

Make a detailed list of potential expenses and carefully check your estimated costs. It’s also helpful to leave yourself a cushion to ensure you have cash for unexpected expenses and build an emergency fund.

If you’re planning to bring on freelancers or independent contractors, make sure you understand how that affects your budget, too. While you won’t have to carry the expenses of traditional employees or directly pay a portion of their premiums, health insurance for independent contractors can be pricey, and contractors often charge higher rates to help offset those and other self-employment costs.

9. Not Managing Cash Flow Effectively

The top reason businesses fail is because their money ran out, Investopedia reports. Note that this is an entirely different problem than a lack of profitability. If you have expenses that need to be paid but won’t have the cash for another month when your clients pay their invoices, your business will be in trouble.

Perform cash flow projections and monitor your cash flow at least weekly. Maintain your cash cushion and set up a backup funding source like invoice factoring to ensure you can close cash flow gaps before they become a problem.

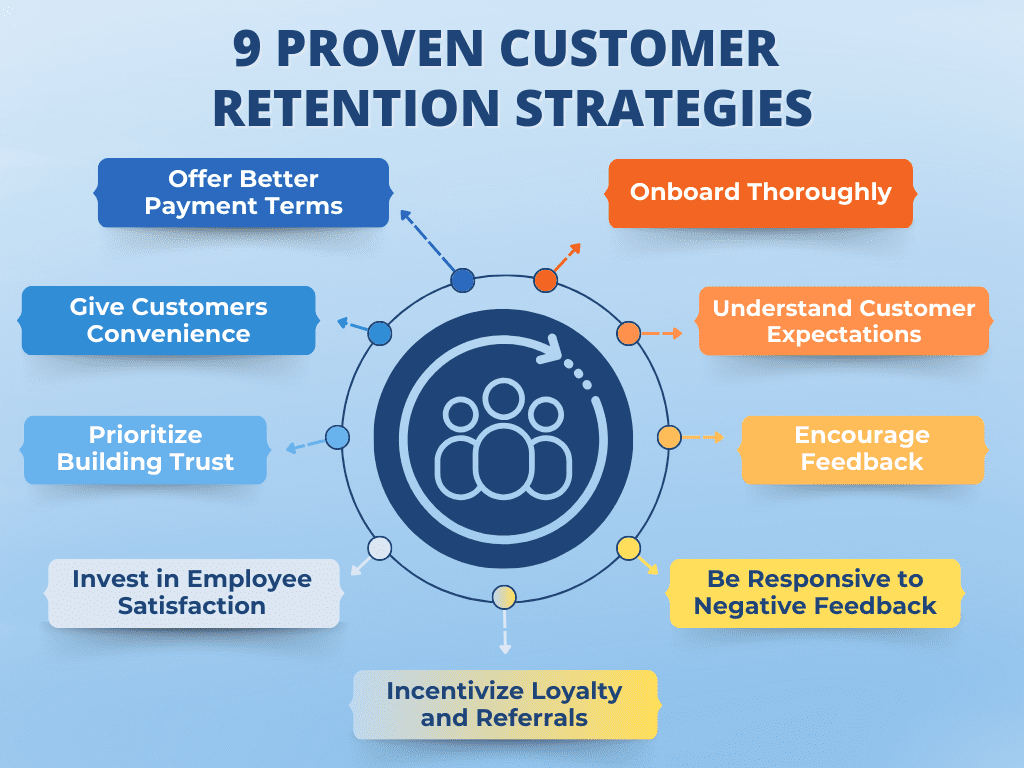

10. Growing Too Fast

Rapid growth is often viewed as a champagne problem, but it can be quite serious because you’re trying to cover today’s higher expenses with yesterday’s lower revenue. You may not have the infrastructure or resources to ramp up quickly either. This is when companies start having problems like coming up short at payroll, not having cash to procure supplies, and feeling tempted to hire without a strategy. Customer satisfaction often falters, too, which can damage your company’s reputation.

If cash flow issues are holding you back from taking on more work, your reserve and backup funding can allow you to push forward. If you’re missing the processes and infrastructure to level up, limiting the amount of work you accept may be better until you’re ready for it.

11. Failing to Pivot

You probably started your business with a vision and determination to make things work. Perseverance is crucial, but knowing when to let go of your plans and pivot is equally important.

Monitor the market and how people respond to your offerings, finances, and organizational processes. You will need to refine these strategies as your company grows. It’s not a failure to change things up. It’s resilience, and it can help ensure your business stands the test of time.

Navigating Startup Challenges: Essential Mistakes to Avoid

For every entrepreneur venturing into the world of startups, understanding and avoiding common startup mistakes is crucial for laying the foundation of a successful business. From the initial excitement of launching a new business or small business, many founders often overlook the significance of conducting thorough market research, creating a robust business plan, and developing a marketing strategy that resonates with prospective customers. One of the biggest mistakes startups make is failing to monitor cash flow and neglecting continuous feedback, which can lead to a lack of product-market fit and, ultimately, the startup’s failure Additionally, you need to make a business plan that addresses startup growth, customer experience, and the right team composition to ensure the success of your business. Learning from the mistakes and pivots of others, making any needed adjustments, and providing a thorough understanding of the market need are essential steps to avoid the common pitfalls that lead to the statistic that 9 out of 10 startups fail. By focusing on these key areas, new business owners can significantly reduce their chances of making common startup mistakes, thereby enhancing the likelihood of their startup’s growth and long-term viability.

Avoid Common Startup Mistakes with Invoice Factoring

Invoice factoring provides instant payment on your B2B invoices, so you can close cash flow gaps and have money as needed for crucial expenses like payroll or ramp-up. It also helps address other issues, such as the time you spend chasing invoices. Plus, it can be a very flexible funding solution when you partner with a factoring company like Charter Capital. Request a complimentary rate quote to get started.