If you’ve ever heard someone from your sales team the moment after a sale is closed, the hoots and hollers coming from the whole department make it clear how monumental it is to close a deal. The sales process can be lengthy, and it truly is a team effort to get a prospect to the finish line. Yet, the same energy is not typically seen in terms of customer retention. It should be. On this page, we’ll walk you through why developing strategies for customer retention is one of the most important things small businesses can do and cover nine proven customer retention strategies anyone can apply and get results from.

What is Customer Retention?

Each time you gain a new customer, it’s called acquisition. Each time you lose a customer, it’s referred to as attrition. The time between these two events is the retention period.

Naturally, the greater the span or the longer customers are retained, the better it is for your small business. Customer retention strategies center on this concept – finding ways to keep customers with your business for longer periods of time.

How to Calculate Your Customer Retention Rate

Customer retention is often measured on a monthly, quarterly, or annual basis using the following formula:

Customer Retention Rate = (Total # of Customers at the End of the Period – New Customers Acquired) / Customers at the Start of the Period

Why Customer Retention Matters

All too often, businesses focus solely on customer acquisition. While it’s true that your business can’t grow without a steady flow of new customers, all the effort that goes into attracting new customers is wasted if they leave right away. Moreover, your existing customers, not your new ones, are likely greater contributors to your business’s growth and profit.

For instance, the probability of selling to an existing customer is 60 to 70 percent, while the likelihood of selling to a new prospect is between five and 20 percent, per invesp. Their research further notes that existing customers are 50 percent more likely to try new products and spend 31 percent more. It also costs up to 25 times more to attract a new customer than to keep an existing one, according to Harvard Business Review (HBR).

For these reasons, businesses that improve customer retention also see higher revenue and greater profit. Just a five percent boost in retention increases profit between 25 and 95 percent, according to Bain and Company.

The Importance of Retention in Business Growth

For many small businesses, the key to long-term growth and success is not just about acquiring new customers but effectively retaining the current ones. Retention marketing, often overlooked, plays a pivotal role in boosting customer lifetime value. An excellent customer service experience, combined with a solid customer retention program, can be your secret weapon to keep them coming back. Implementing customer retention strategies that work, especially strategies tailored for small businesses, can significantly reduce customer churn. Engaging with every customer individually, understanding their needs, and promptly addressing customer complaints can create a customer experience that cultivates loyalty. Harnessing customer feedback, employing tools like customer relationship management, providing exceptional customer service, and knowing how to ask for the next customer order in a natural, helpful way are all part of a holistic approach to increasing customer retention rates. As a small business owner, embracing these strategies can improve customer retention and amplify repeat business, enhancing overall customer value. Remember, it’s not just about the first purchase; it’s about creating an environment where customers are more likely to engage with your business again and again.

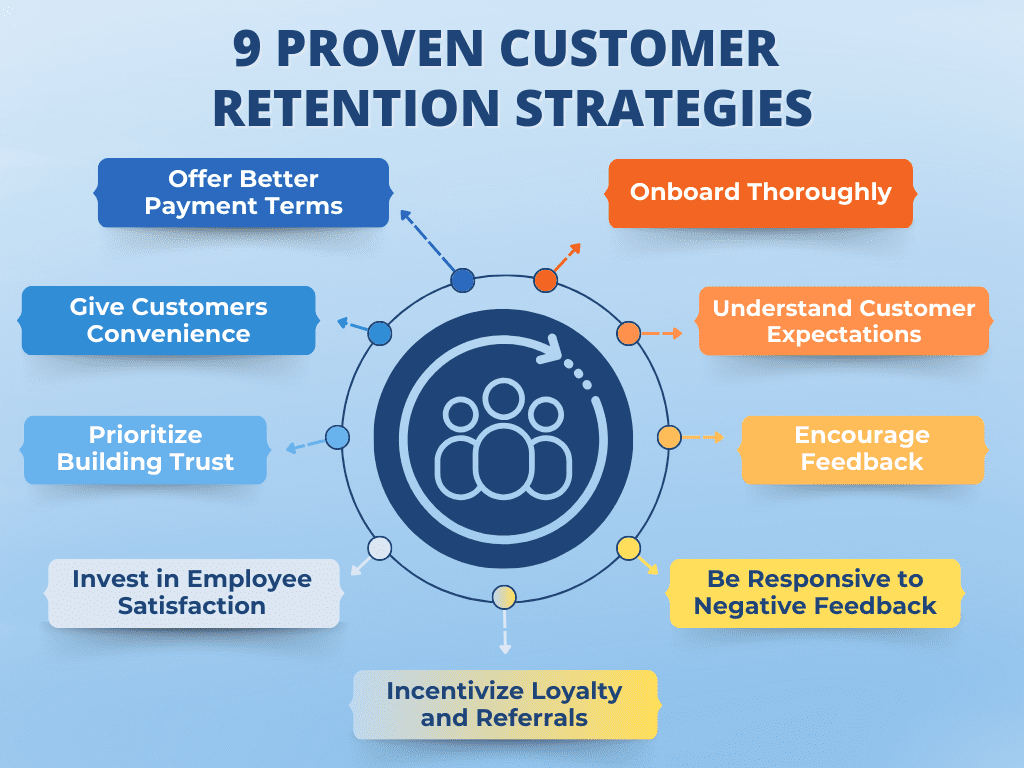

9 Proven Customer Retention Strategies for Small Business Owners

It’s easier than you might think to weave proven customer retention strategies into your everyday activities. Below, we’ll cover nine areas to address, so you can start building a stronger business immediately.

1. Onboard Thoroughly

Onboarding is more than just an official welcome into your customer family. The more comfortable someone is with your product or service, and the more they leverage it, the more likely they are to stick with it. Work with your customer service and product development teams to identify new customers’ struggles and areas of low adoption. Then, explore ways to educate newcomers. While some, especially SaaS companies, may benefit more from training, others can address onboarding through educational emails or videos sent at specific intervals after someone becomes a customer.

2. Develop a Deep Understanding of Your Customers’ Expectations

Your customers come to you with their own ideas of how your product or service should work, their preferred methods of communication, and how quickly your team should address concerns. The more you understand their expectations and proactively rise to meet them, the less friction your customers will experience and the more likely they are to stick with you.

3. Encourage Customer Feedback and Learn from It

Nine in ten customers say brands should offer the opportunity to provide feedback, according to Microsoft surveys. Yet, many don’t request feedback, and more than half of customers say brands don’t take action even if they provide insights.

Reach out to your customers at critical points in their journey, such as immediately after a sale, during onboarding, and a few weeks or months after. This simple act will make 77 percent of customers view your brand more favorably, Microsoft research shows.

Net promoter surveys and scores can provide a wealth of information too. These are one-question surveys that say something like, “How likely are you to recommend our product/ service/ brand to a friend/ family member/ colleague?” The customer is then asked to provide a score between one and ten, with ten being the most likely and one being unlikely. Those who answer with a score between one and six are considered detractors. A seven or eight represents a passive answer. Those who provide a rating of nine or ten are considered promoters. A net promoter score (NPS) is calculated by subtracting the total detractors from the total promotors.

NPS scores are often regarded as the leading predictor of long-term business success. Typical scores range from 25 to 30 and vary by industry. Because the survey takes just seconds to answer, you’re likely to get more responses and can conduct surveys on an ongoing basis quite easily.

4. Be Responsive, Even When Feedback is Negative

“Your most unhappy customers are your greatest source of learning,” Bill Gates once said. Use the information they’re entrusting you with to develop your offerings and meet their needs better.

Regardless of whether you can act on their feedback, always express appreciation for their time and effort. You may not always be able to resolve a concern, but sometimes customers are satisfied simply by feeling heard.

5. Incentivize Customer Loyalty and Referrals

Four in five people say they’re more likely to stay with a brand that offers a customer loyalty program, according to Nielsen research. Create a loyalty or rewards program that suits your brand. For instance, you might offer perks for customers who have stayed on a subscription plan for an extended period or award points for each purchase.

Referral programs can also be a boon for your business and retention. A referred customer is 18 percent more loyal than one who comes to your business through other channels, according to Annex Cloud. Referred clients have a 37 percent higher retention rate and are four times more likely to refer more customers to your business too. Tailor your referral program to your business model. Some businesses, such as professional service companies, tend to do best with programs that offer cash payouts for each referral, while others, such as retailers, usually have greater success by providing discounts and free products for each referral.

6. Invest in Employee Development and Satisfaction

Happy employees create happy customers. Researchers looked at Glassdoor ratings for companies in one HBR study. They found that a single-star increase in employee satisfaction correlates with a three-point increase in customer satisfaction. Loyalty also gets a boost when employees are more engaged.

Moreover, happy employees will stay with your company longer, which gives them lots of time to build up their knowledge of your philosophies and product, allowing them to serve your customers better and boost satisfaction.

7. Prioritize Building Trust with Your Customers

More than 80 percent of customers say trust is an important factor in their decision to support a brand, per Edelman research. Moreover, customers who trust your brand are significantly more likely to promote it, stay loyal, and defend your company if need be.

Trust doesn’t come easily, however. It’s built over time as people see you follow through on your promises and stay true to your mission. If your brand supports specific causes, share what you’re doing to help. You can also share testimonials and case studies demonstrating times you’ve followed through on your company mission, even when challenging.

8. Give Your Customers Convenience

The absence of friction is everything in today’s busy world. Walk through your typical customer journey to identify and eliminate potential friction points. For instance, some brands allow customers to pick up orders rather than have them shipped to speed up timelines. Others provide self-service ordering, scheduling, and payment tools.

9. Offer Your Customers Better Payment Terms

If your clients make payments after goods or services are delivered, take a hard look at your payment terms and how they impact your customer relationships. If you can give them longer windows to pay or ease their burden in some way, especially if competitors aren’t doing so, you can win their loyalty for life.

Consider Invoice Factoring to Reduce Your Accounts Receivable Burden

Most small businesses can’t afford to wait for payment. If you’d like to offer your clients better payment terms but can’t due to cash flow concerns, invoice factoring can help by providing you with cash for your receivables. With factoring, you sell your unpaid invoices to a third party, known as a factor or factoring company. The factoring company immediately pays you most of the invoice’s value, then waits for your customer to pay. When the invoice is paid, you receive the remaining balance minus a nominal factoring fee.

Improve Your Customer Retention Strategy with Invoice Factoring

Charter Capital, a leading invoice factoring company, can provide you with an immediate cash injection to implement the strategies outlined here or allow you to provide your customers with better terms. To learn more or get started, request a complimentary rate quote.