Government contracts can be challenging to win and navigate, but they’re also some of the most lucrative and dependable contracts you can have. On this page, we’ll walk you through why you may experience delayed payments and cash flow challenges and how government contractor factoring creates a financial bridge that allows you to bid on, accept, and manage these contracts more confidently.

Navigating Payments in Government Contracting

For the most part, the government must pay contractors on net 30 terms, as Wolters Kluwer notes. This means you’re paid within 30 days or less of submitting your invoice, but it doesn’t necessarily mean you’ll get paid when you expect. While prompt payment terms are intended to keep contract obligations running smoothly, delays can still occur due to missing documentation, incorrect banking information, or disputes over the services performed as specified in this contract.

Payment Terms Vary by Contract

As you explore government contract opportunities, pay close attention to the payment timing mentioned. There are many different payment timelines. For instance, some offer progress payments or pay by milestone, in which case you can submit your invoice as soon as you’ve met the requirements or milestones. Others, especially those involving tangible goods, may allow you to submit an invoice immediately after delivery. You’re also likely to see monthly billing terms on service-type contracts. This means that even if you’re promised net 30 terms, you may not get paid within 30 days.

To illustrate, picture a website development company that wins a bid for designing a new website for a government agency. It’s an expansive project with dozens of professionals that is expected to take a full year. Rather than paying out only at the end, the developer may have a milestone-based contract that provides payments as the company meets specific goals. Now, imagine it takes the developer 90 days to meet its first milestone, and it sends the invoice right away. Because the government has 30 days to pay, a total of 120 days may pass from the time the business makes its first cash outlay for the project until the day it receives cash.

Public Sector Contracts May Not Always Pay “On Time”

As you can see, this already creates a wide range of payment timelines, but there are lots of other reasons why a net 30 timeline may not always pan out.

Work Disputes

Occasionally, there may be a dispute about whether you’ve delivered services or goods as outlined in your contract. This must be resolved before the invoice is approved for processing.

Incorrect Invoicing

The 30-day timeline only begins when the government receives a “proper” invoice. Although there are many reasons why invoices get kicked back for non-compliance, a few of the most common issues include issues with:

- Dates

- Contract numbers

- Company name and address

- Contact info for the person receiving the payment

- Shipping and payment terms

- Details about the items or services delivered

The government has seven days after receiving your invoice to respond if invoice issues will prevent payment. Unfortunately, businesses can go back and forth quite a bit while issuing corrected invoices, which may further delay the payment.

Common Payment Delays in Government Contracts

Understanding the contractual provisions in a federal contract is essential for any federal contractor, as terms related to designated payment, invoice amount, and liability for overdue payments can impact how agencies make payments and manage obligations.

Navigating FAR Parts and Payment Regulations

Federal Acquisition Regulation (FAR) parts are essential for understanding the payment processes in government contracts. The prompt payment clause requires payment within 30 days of receiving a proper invoice, but various factors can still cause delays. Familiarity with FAR parts and specific clauses helps contractors navigate payment challenges and seek remedies for compensable delays.

Impact of Late Payment Interest on Cash Flow

Late payment interest is critical for managing cash flow. When the government delays payment beyond the due date, interest is owed. Contractors should track payment dates, delay periods, and notify the contracting officer promptly to claim late payment interest, thus mitigating financial strain.

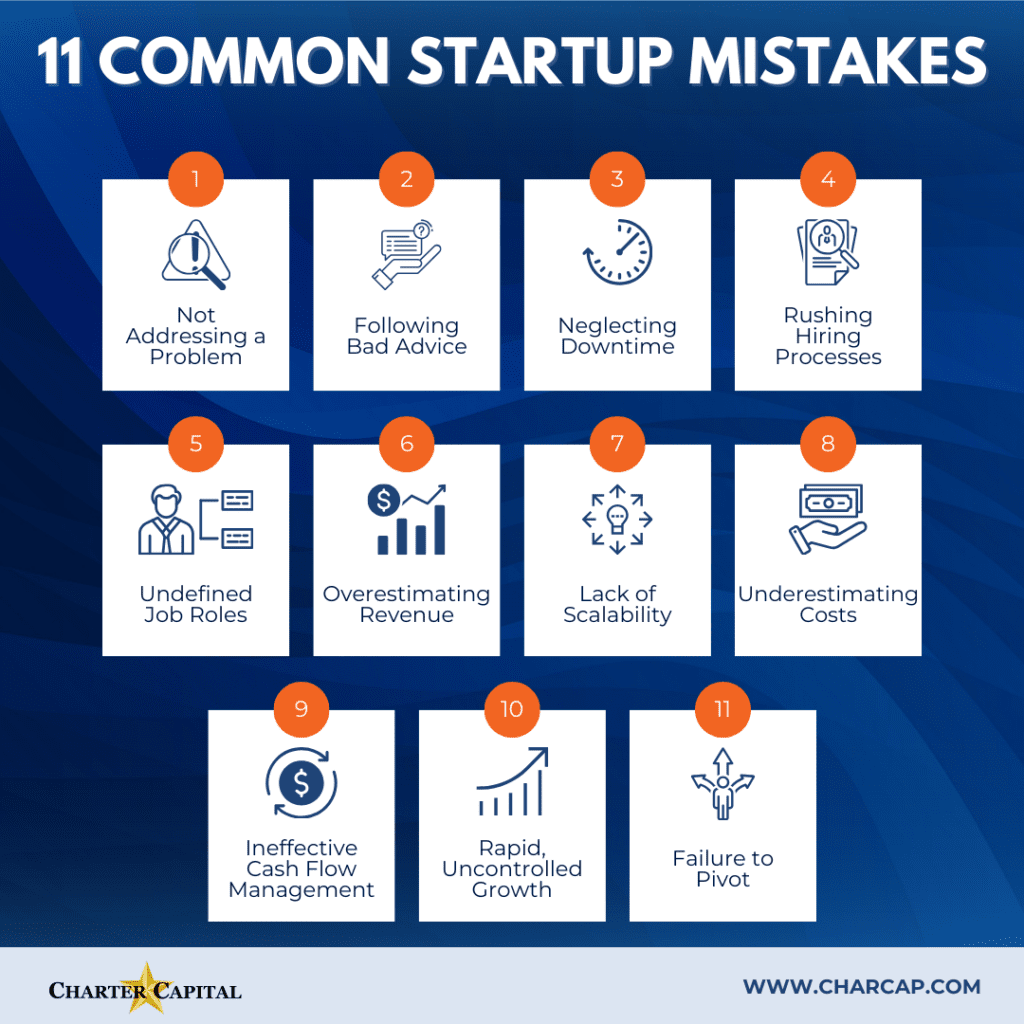

Payment Delays Can Create Major Issues for Businesses

Many small businesses and startups are dissuaded from bidding on government contracts because they lack the upfront cash necessary to accept these projects, particularly when payment delays are likely.

Effects of Payment Delays

Government contractors experience a variety of issues when payments are slow, such as:

- Added expenses and time for chasing and resubmitting invoices

- Inability to cover their own expenses, such as rent and payroll

- Inability to continue working on the project due to capital needs

- Inability to seize opportunities due to limited capital

Strategies to Manage and Mitigate Payment Delays

Effective Contract Administration Tools and Techniques

Effective contract administration is vital for managing payment delays. Utilizing automated systems for tracking invoices and maintaining detailed records of communications helps prevent delays. Proactively addressing issues ensures timely submission and approval of invoices, avoiding administrative oversights.

Handling Termination and Late Payments

When facing termination or late payments, contractors must notify the contracting officer in writing, detailing delays, costs incurred, and impacts on performance. Understanding contract terms and documenting issues is crucial for seeking compensation and managing financial impacts.

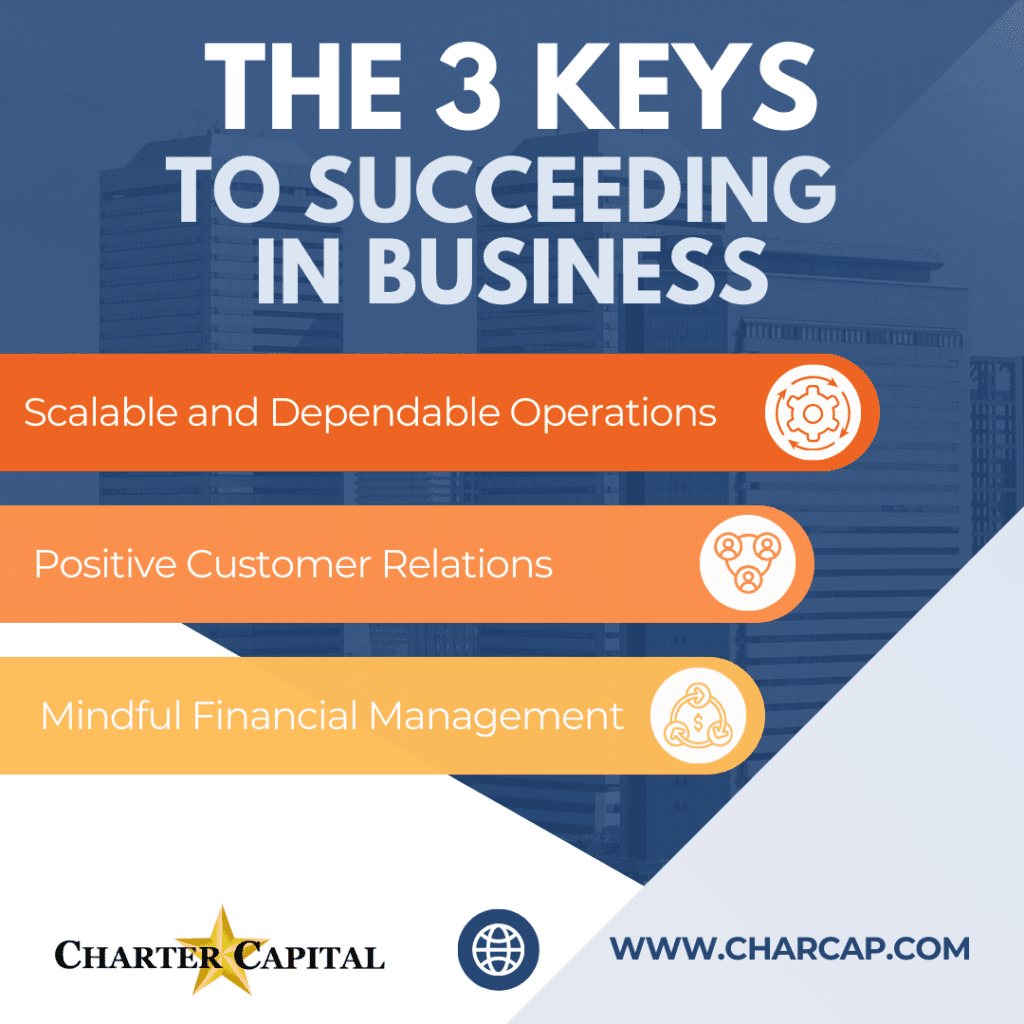

Factoring: The Bridge Over Financial Gaps

Large and established contractors can often tap into loans and lines of credit when accepting bids. However, many are debt-averse and prefer not to. Moreover, liquidity solutions are few and far between for those in the early days of government contracting because they don’t typically meet the history and credit requirements. This is where a solution like factoring can help.

Factoring: A Reliable Solution for Government Contractors

Addressing Late Payment Issues with Factoring

Factoring provides a solution for late payments by offering immediate cash flow through the sale of unpaid invoices. This helps contractors maintain operations without waiting for government payments, especially when facing government-caused delays.

Benefits of Factoring for Federal Construction Projects

Factoring benefits federal construction projects by providing immediate cash flow, simplifying financial forecasting, and allowing contractors to cover expenses and continue work without delays. This predictability aids in better budgeting and planning.

Factoring Solutions Tailored for Government Contractors

Factoring is a unique funding solution in which your business sells its unpaid invoice to a factoring company like Charter Capital at a slight discount. The factoring company immediately pays you most of the invoice’s value and takes over responsibility for collecting the payment. You’re free to move forward without chasing payments or paying a debt back.

How Factoring Works

Factoring is a straightforward process for government contractors.

- Step 1: Win a government contract and go to work.

- Step 2: Send copies of the invoice to the government and your factoring company.

- Step 3: Get paid most of the invoice’s value immediately by the factoring company.

- Step 4: Keep working and growing your company. The factoring company will follow up on the invoice as needed and send you the remaining sum minus a small factoring fee once the government’s payment comes in.

Eligibility for Factoring

Unlike loans, lines of credit, and other traditional funding solutions, your creditworthiness and time in business aren’t a major consideration for approval. Instead, the factor is more concerned with the creditworthiness of your customers since they’re the ones paying the bill. This means getting approved is very easy if you’re working on a government contract. You may be able to factor invoices for many of your private sector clients, too.

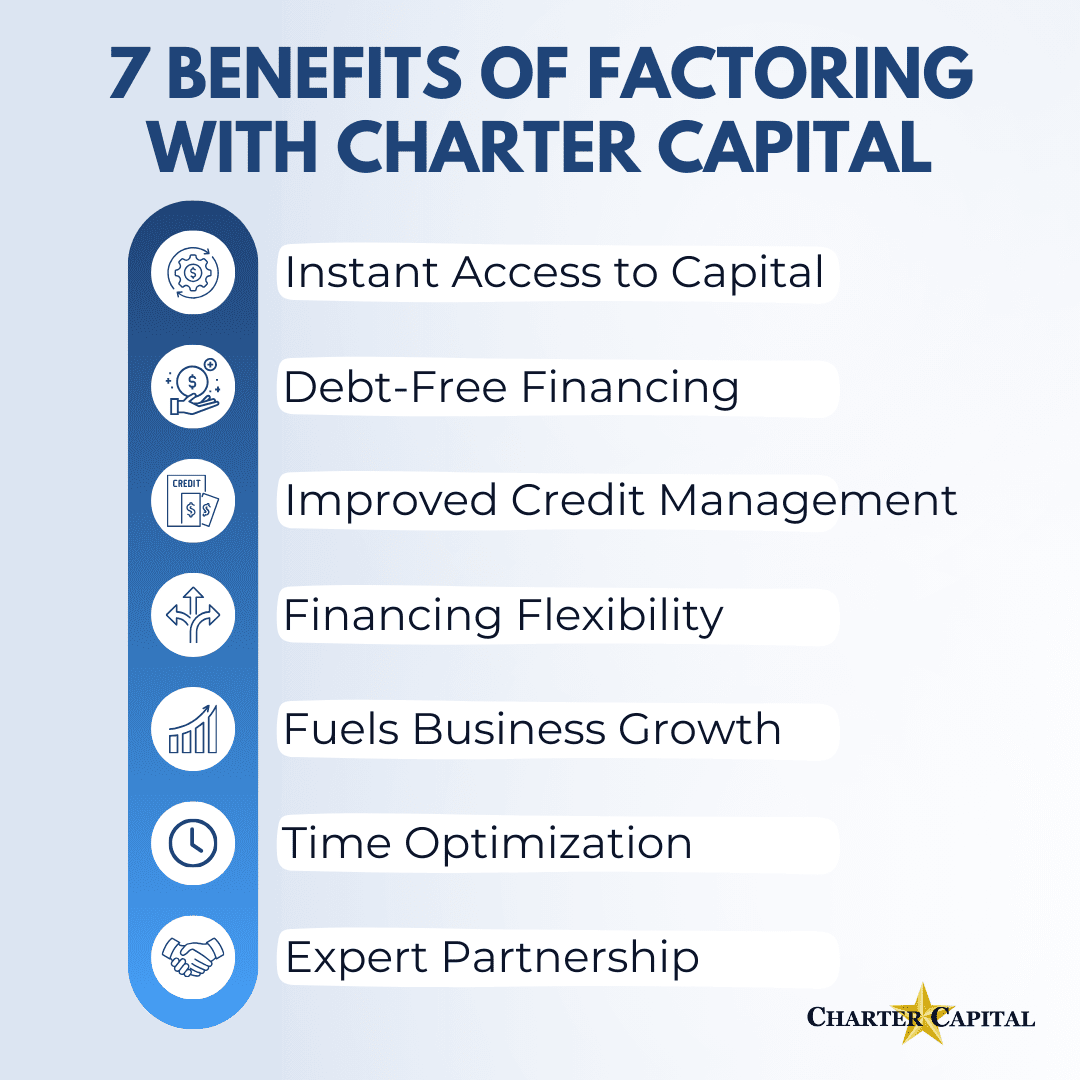

Benefits of Factoring vs. Waiting

There are lots of benefits to leveraging government contractor factoring. We’ll explore a few below.

Immediate Cash Access

Your business receives payment right away with factoring. It’s typically sent as an automated clearing house (ACH) payment, which means it’s sent electronically and arrives in your bank account within 24-48 hours. However, factoring companies like Charter Capital can expedite it even more beyond this and pay you on the very same day you submit your invoice.

Continuous Business Operations

Factoring bridges cash flow gaps so you can cover daily expenses and grow.

Simplified Forecasting

With factoring, you always know exactly when you’ll get paid so that you can budget more confidently.

Planning for Future Contracts

Factoring doesn’t have to be all or nothing. You can dip into it whenever you need to accelerate cash flow. This often opens doors for government contractors as they explore opportunities – you can bid on the projects that suit you and not just the ones that pay out on your ideal timeline.

Eligibility and Benefits of Factoring for Government Contractors

Criteria for Factoring Approval

Approval for factoring primarily depends on the creditworthiness of the government entity. Contractors should ensure invoices are free from disputes and meet contract specifications to expedite the approval process and access factoring benefits quickly.

Factoring vs. Traditional Financing Options

Factoring offers immediate cash flow without adding debt, unlike traditional loans. It is flexible, allowing contractors to factor specific invoices as needed, which is particularly beneficial for managing federal construction contracts with varying payment schedules.

Practical Steps to Implement Factoring in Your Business

Selecting the Right Factoring Company

Choosing a reputable factoring company experienced in government contracts is crucial. Consider advance rates, fees, and payment speed, and ensure the agreement aligns with your needs to maximize the benefits of factoring.

Maximizing Cash Flow with Same-Day Payments

Same-day payments from factoring companies ensure funds are available immediately, helping contractors meet financial obligations without delay. This is especially beneficial for managing cash flow during government-caused delays.

Bridge Your Financial Gaps with Government Contractor Factoring

If it sounds like government contractor factoring may be what you’re looking for to bridge financial gaps, Charter Capital can help. We offer low rates, up to 100 percent advances, same-day payments, and don’t require long-term contracts. To explore the fit for your business, request a complimentary rate quote.