There’s no shortage of leadership and self-improvement books on the shelf today, but which are really the best books for small business owners? In this article, we’ll explore everything from time-tested classics to often-overlooked gems that cover leadership, marketing, warfare, and more, to inspire you and help you grow your business.

Why Small Business Owners Need to Read More

Reading is good for everyone, but business owners can benefit from reading even more for a myriad of reasons.

Reading Expands Your Vocabulary and Improves Your Speaking

Studies indicate that regular reading actually changes the brain and can help strengthen the areas responsible for vocabulary and communication, according to the Telegraph. The more you read, the more likely you are to come across words and phrases you haven’t seen before. You also pick up different ways of pulling thoughts and ideas together. Both these things can help you become a better speaker too.

Reading Boots Brain Power

Research also shows that there are additional benefits to choosing more difficult texts. Those who read Bard and other classical writers, for example, see more activity in brain scans and are more likely to engage in self-reflection, according to the Telegraph. Reading also helps improve memory, per University of Illinois research.

Reading Can Help You Navigate Social Relationships

Many of the books for small business owners covered here focus on building relationships. For instance, some cover how to talk to customers, employees, and partners in a way that generates goodwill, while others teach you which relationships to extract yourself from to increase your odds of success.

But, even if you don’t choose non-fiction books for small businesses, reading can still boost empathy, according to National Endowment for the Arts. This is because reading about the thoughts and behaviors of different characters helps us appreciate their inner lives and experiences. As we become more compassionate toward people unlike ourselves through reading, we carry that empathy with us into everyday life.

Reading is Good for Stress Management

Reading reduces stress levels by 68 percent, according to the National Endowment for the Arts. That makes it more effective than playing video games, drinking a cup of tea, or even taking a walk.

Reading Better Equips You to Make Informed Decisions

Business owners face new challenges every day. When you read, you pick up information that you wouldn’t otherwise have from direct experience. You can apply the teachings to daily decisions to make smarter decisions even in situations you haven’t faced before.

Reading Can Help You Find Answers to Business Problems

Many books on small business serve as complete guides that walk you through specific solutions and how to implement them, while others provide you with the framework necessary to develop your own solutions.

15 Best Books for Small Business Owners and Entrepreneurs

Now that we’ve covered the basics, let’s look at some of the best books to read for small business owners.

1. Start with Why: How Great Leaders Inspire Everyone to Take Action by Simon Sinek

“People don’t buy WHAT you do, they buy WHY you do it.”

“Start with Why” is one of the best books for new business owners because it can help you gain a greater understanding of why people choose one product or service over another using real-world examples of companies like Apple. When you start with why, you create a brand that truly meets your customers’ needs and primes your business for greater growth.

2. Guerilla Marketing: Easy and Inexpensive Strategies for Making Big Profits from Your Small Business by Jay Conrad Levinson

“The road to profitability is paved with credibility. Credibility is something you earn by how you market, where you market, how you treat people, how you act, and your overall level of professionalism.”

“Guerilla Marketing” is one of the absolute best books for new business owners. Originally published in 1985, Levinson’s staple for entrepreneurs has been revamped repeatedly over the years to address the latest trends. The book contends that small businesses and those on a budget can gain a competitive edge by engaging with consumers in a way Goliath brands can’t – by infiltrating their lives and creating a shared story.

3. Digital Marketing Outsourcing: The Ultimate Recipe for Growing Your Business Online by Husam Jandal

“The behavior of your customers will change. New technology will emerge. When you have the right people on board, they’ll ensure your strategies and initiatives continue to deliver ROMI year after year.”

Developing a digital marketing strategy that can genuinely help a business scale and deliver a return on marketing investment (ROMI) can seem daunting for small business owners. However, in “Digital Marketing Outsourcing: The Ultimate Recipe for Growing Your Business Online,” Husam Jandal walks readers through a leadership-based approach that involves bringing the right people and processes together to create a recipe for success any business can follow.

4. Dare to Lead: Brave Work. Tough Conversations. Whole Hearts. by Brené Brown

“We fail the minute we let someone else define success for us.”

All too often, people feel like they need to be completely fearless, infallible, and untouchable to be good leaders. Brown breaks through the paradigm and insists that traits such as vulnerability, a willingness to be challenged, and the courage to move forward despite adversity are the keys to becoming a leader that people are passionate about following.

5. The Little Red Book of Selling by Jeffrey Gitomer

“Talk profit and productivity—NOT SAVING MONEY—talk ideas and opportunities—NOT A CHANCE TO TELL YOU WHAT I DO—they want friendly, help, answers, productivity, and profit.”

Whether you’re trying to land your first sales or are building out your team and need to develop a framework for reps to follow, “The Little Red Book of Selling” is an excellent playbook. Gitomer breaks things down into a set of clear rules that anyone can follow. For instance, you shouldn’t “sell” to your prospects. Focus first on being a resource to them. When they value you, they’ll value the solutions you bring them.

6. The 7 Habits of Highly Effective People: Powerful Lessons in Personal Change by Stephen Covey

“Most people do not listen with the intent to understand; they listen with the intent to reply.”

Despite being regarded as one of the top business books for leaders and entrepreneurs, “The 7 Habits of Highly Effective People” does not promise to transform the way you operate overnight. Instead, it walks readers through habits like listening to understand before trying to be understood, being proactive, and how these traits manifest in everyday life. Once you’re familiar with them, you’ll be able to spot them in others and can begin developing the habits too.

7. The Art of War by Sun Tzu

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

Despite being penned on the topic of warfare thousands of years ago, “The Art of War” is often regarded as one of the best business books to read because it can help you learn how to be fiercely strategic. Spanning 13 chapters, the book covers everything from strategic attack to adaptability and even intelligence and espionage.

8. The E-Myth Revisited: Why Most Small Businesses Don’t Work and What to Do About It by Michael E. Gerber

“People who are exceptionally good in business aren’t so because of what they know but because of their insatiable need to know more.”

In “The E-Myth Revisited,” Michael Gerber forces entrepreneurs to face an uncomfortable truth: knowing your craft like the back of your hand is not enough. To find success, business owners must also tap into their entrepreneurial and managerial skills, leverage proven business models, and use repeatable processes to duplicate success.

9. Give and Take: A Revolutionary Approach to Success by Adam Grant

“The more I help out, the more successful I become. But I measure success in what it has done for the people around me. That is the real accolade.”

“Give and Take” operates on the premise that people fall into one of three categories based on how they interact with others: givers, takers, and matchers. Givers act in the interest of others, even at a cost to themselves. Takers act out of self-interest. Matchers base decisions on an expectation of reciprocity or perceived fairness. You’ll have to read the book to find out which group comes out on top and how to incorporate their behaviors into your strategy to increase your success.

10. The Magic of Thinking Big by David J. Schwartz

“People who get things done in this world don’t wait for the spirit to move them; they move the spirit.”

If you’ve ever felt like the universe was conspiring against you, like you face more challenges than others, or that external forces are preventing you from scaling your business in a meaningful way, “The Magic of Thinking Big” is for you. Schwartz explores success from a variety of angles, including what you really need in order to be successful and the types of people to surround yourself with to put the odds in your favor.

11. The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich by Timothy Ferriss

“The question you should be asking isn’t ‘What do I want?’, or ‘What are my goals?’, but ‘What would excite me?’”

Somewhere along the way, we developed a culture in which around-the-clock work was deemed ideal. The more hours you work, the more dedicated and successful you’re perceived. The problem isn’t just that this logic is flawed. Productivity drops when you work excessive hours. The issue is that the logic is flawed, and the lifestyle is unsustainable. It’s no wonder that 42 percent of small business owners say they’ve experienced burnout within the past month, according to Forbes research. You might not be ready to drop down to just four hours per week, but Ferriss can still teach you how to make the most of your time to maximize results and help you discover ways to reenergize and truly enjoy life.

12. The Power of Habit by Charles Duhigg

“If you believe you can change—if you make it a habit—the change becomes real. This is the real power of habit: the insight that your habits are what you choose them to be.”

Whether you have personal goals like saving for a vacation or eating better, you want to transform your organization by eradicating productivity-draining habits, or you’re trying to find ways to get your customers to order more often, “The Power of Habit” is your guide. Duhigg examines the science behind why we go on autopilot and form habits, using familiar experiences and brands to give readers the insights to enact real, lasting change.

13. Rich Dad, Poor Dad by Robert Kiyosaki

“Most people never get wealthy simply because they are not trained financially to recognize opportunities right in front of them.”

“Rich Dad, Poor Dad” isn’t often thought of as one of the great books for business, but it deserves a place on the list. It’s like getting a crash course in finance over a weekend of reading. Kiyosaki walks readers through everything from cash flow management to investing, using real-world examples to demonstrate how picking up specific financial skills impacts a person’s entire life. Given that more than 40 percent of small business owners describe themselves as financially illiterate, per Intuit, and 82 percent of business failure is tied to poor cash management, according to Small Business Trends, “Rich Dad, Poor Dad” should be a priority read.

14. The Effective Executive by Peter F. Drucker

“The less an organization has to do to produce results, the better it does its job.”

If you only read one running a small business book related to leadership, “The Effective Executive” should be it. Drucker walks readers through what motivates people to do well and how to engage with others in a way that boosts productivity and morale.

15. How to Win Friends and Influence People by Dale Carnegie

“You can’t win an argument. If you lose it, you lose it; and if you win it, you lose it.”

Carnegie is often considered a pioneer in the self-improvement genre. The core message of “How to Win Friends and Influence People” could easily be summed up as “behave like a decent human being who cares about others,” but it delves much deeper than that. He gives clear examples of times people commonly miss the mark and provides insights on communication that can help you form better relationships with everyone you come in contact with, from employees to prospective clients.

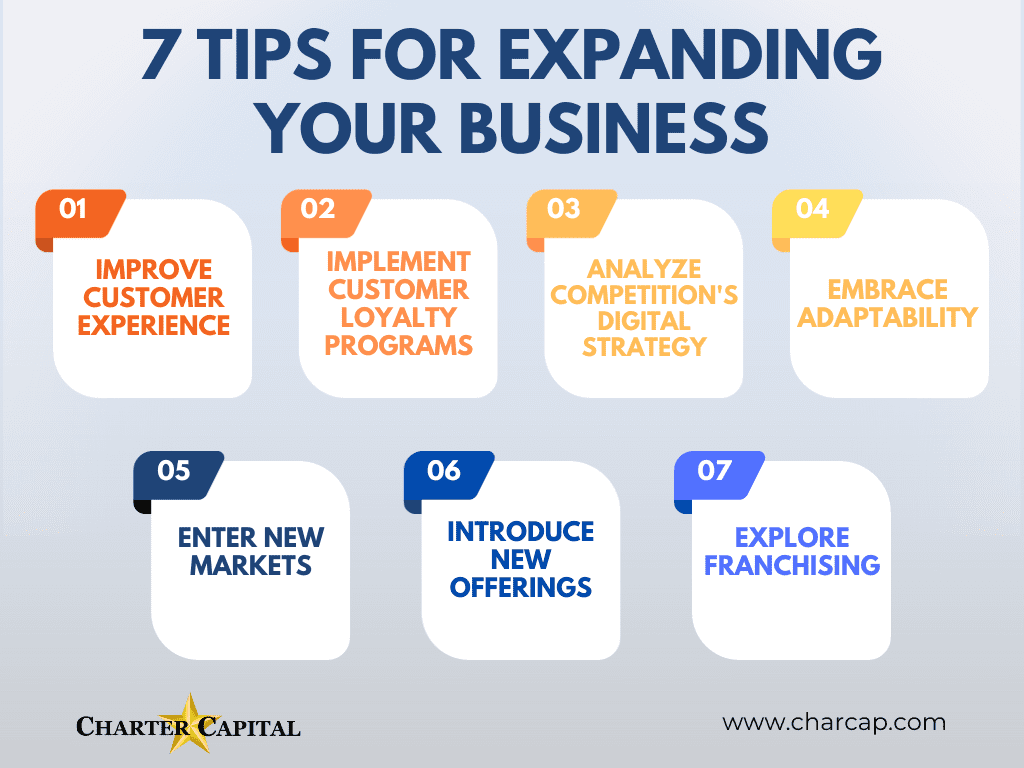

Get the Working Capital You Need to Follow Through on Your Aspirations

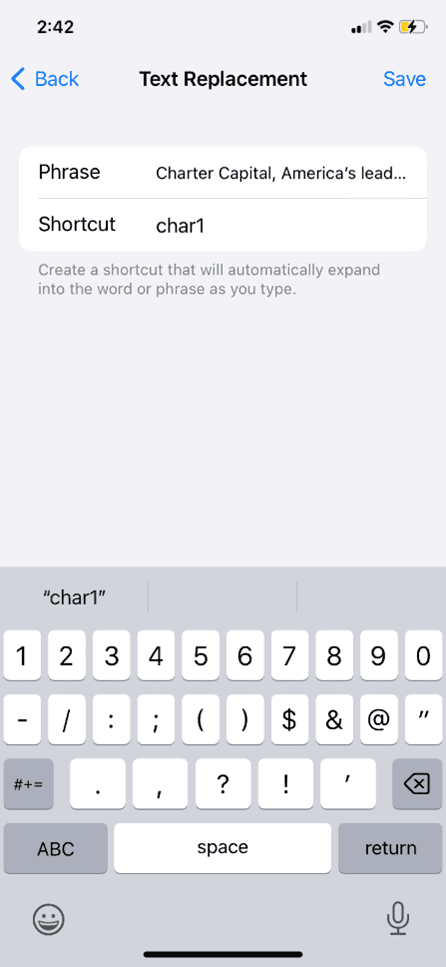

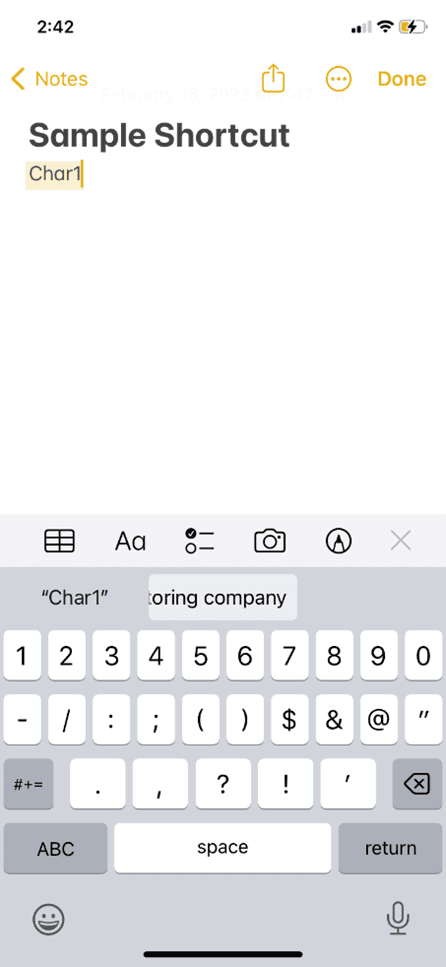

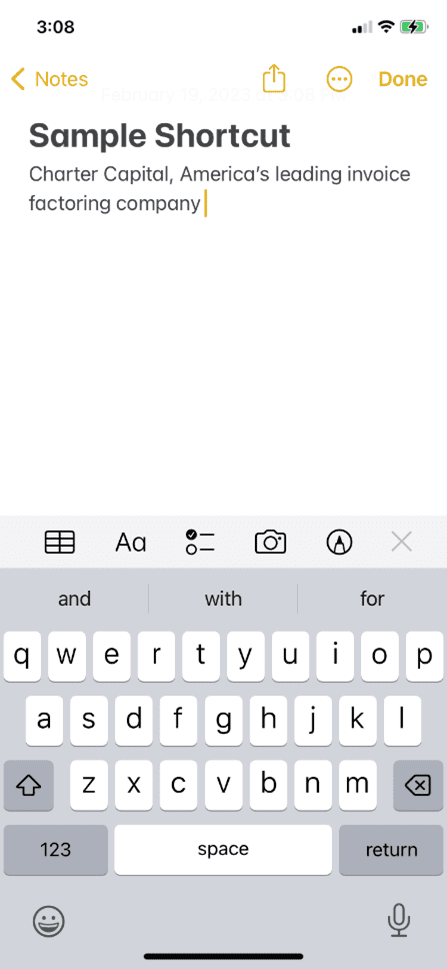

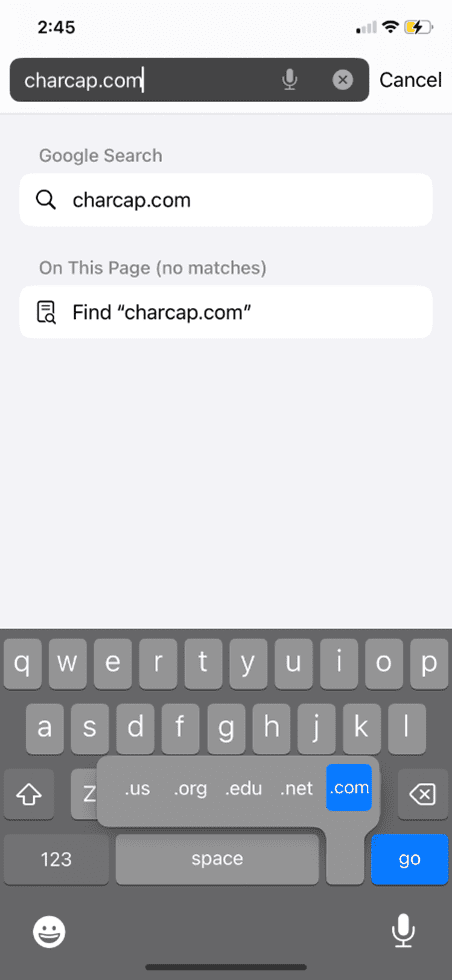

Charter Capital is committed to helping small businesses thrive. We understand the unique challenges that small business owners face and offer flexible factoring solutions tailored to your business needs. Whether you are just starting or have been running a business for years, we are here to provide the financial support you need.

Want to boost your business? Don’t let a lack of capital hold you back. Contact Charter Capital for a complimentary factoring rate quote and unlock the potential of your business.