Wondering how to buy out a business partner? You’re not alone. Just under 12 percent of small employer firms are legally classified as partnerships according to the U.S. Small Business Administration (SBA), which means around 74,000 are formed every year. About half will break up within four years per Antonoplos & Associates.

As you navigate this uncertain terrain, you’re probably wondering:

- Can I buy out my business partner?

- Can my business partner push me out?

- What is the best way to buy out a business partner?

- What are the alternatives to partner buyouts?

The short answers to the first two questions are “yes” and “sort of,” but the reality is that breaking up is complicated. It’s not unlike the dissolution of a marriage. There are certainly wrong ways to do it, but there are lots of right ways to do it too. It’s up to you to find a way that works for you, your partner, and the company. These tips will help you determine how to buy out a business partner in a way that helps you all find the best path forward.

1. Keep the Process Positive and Friendly Throughout

First and foremost, keep things friendly and civil. Remember why you initially chose your business partner and consider that you’ve both likely poured blood, sweat, and tears into the company. Maybe your partner has let you down in a big way, or you no longer see eye-to-eye on crucial business matters. When you’re ready to break up, that no longer matters. What does matter is ending things amicably with as little collateral damage as possible. You must try to keep things friendly and eliminate emotion from the process as much as possible to make that happen.

2. Communicate Your Expectations from the Beginning

Before you approach your soon-to-be-ex, ask yourself the following questions:

- Why do I want to buy out my partner?

- Am I ok with my partner maintaining some involvement with the company?

- What do I hope to get out of the buyout?

- Of all my buyout goals, what matters most?

The answers you give will make it easier to negotiate the termination of your partnership and communicate your wishes and negotiate a solution that works for everyone involved.

For example, maybe your business partner is a close friend who recently became ill and is no longer carrying their weight, but you still want to ensure they’re taken care of and that hurt feelings are minimized during the breakup. You might be ok with this person staying somewhat involved with the company. Conversely, if your business partner was never a close friend and recently made a series of rash decisions that hurt the company or damaged the business’s reputation, you probably want them out as quickly and silently as possible.

When you have a firm grasp of why you want to end the partnership and what you hope to achieve, communicate your expectations to your partner.

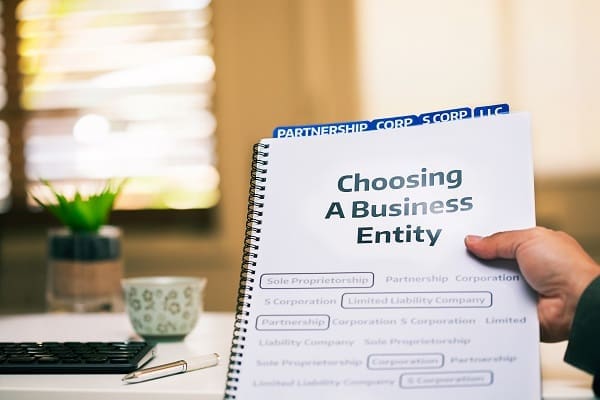

3. Review Your Operating Agreement and Relevant Documents for Buyouts

Ideally, you will have created a buy-sell agreement with your partner already. This document, typically signed when a partnership is formed, outlines all terms and conditions associated with buying out a partner. It usually covers situations like incapacitation, retirement, and voluntary exit. Sometimes buy-sell agreements cover extenuating circumstances as well.

You can use this and similar documents to guide you now. Even if you disagree, or your partner isn’t ready to let go yet, valuation clauses, payment guidelines, and other decisions you once agreed upon can pave the way for smooth negotiations today.

4. Determine the Value of the Business and Your Partner’s Equity Stake

There are many approaches to business valuations, including:

- Adjusted Net Asset Method

- Capitalization of Cash Flow Method

- Discounted Cash Flow Method

- Market-Based Valuation Method

- Seller’s Discretionary Earnings Method

If you chose a valuation method as part of a buy-sell agreement created when the partnership was formed, you might be able to avoid conflict by using that method now. If there’s disagreement about the value of the company, consider bringing in a business valuation expert or having both of you create an estimate and use the average to determine a fair value.

5. Hire an Experienced Mergers & Acquisitions Lawyer

There are two main ways business partnerships end: dissolution and disassociation.

- Dissolution: When a partnership ends via dissolution, the business is required to wind up its business activities. Debts are paid off, assets are split, and the business usually shuts down.

- Disassociation: When a partnership ends via disassociation, it means one partner is withdrawing from the partnership. The “partnership” or remaining partner must buy out the dissociating partner’s interest in the company.

Laws Are State-Specific

If your goal is to buy out your partner, it will generally be a disassociation. This is likely the case even if the partner leaving is in breach of your partnership agreement or has behaved unlawfully. Sometimes dissolution is necessary, though. This is often the case if courts must get involved. For example, if partners cannot agree on a buyout plan or if the company is in financial trouble and creditors get involved.

With that said, there are no steadfast rules. The laws related to ending a business partnership will vary by state, the type of partnership, any contracts or business agreements you have, and how the partnership is ending. It’s important to work with an experienced mergers and acquisitions lawyer even if you and your partner agree on how to end the relationship because of this.

A seasoned attorney will ensure all documents are filed, that the departing partner is released from any liability and that the remaining partner holds all interest to which he is entitled.

6. Consider All Your Financing Options

Before you start drawing up contracts, you’ll need to know how you plan to purchase your partner’s share of the company. You’ll likely be choosing between one of the methods outlined below if you don’t have personal funds to cover the transaction.

Loans

In theory, bank loans are a good way to finance a partnership buyout, particularly if you require a large lump sum. However, banks usually expect businesses to turn the cash they loan out into something that will help grow the company. Buyouts don’t boost the bottom line, so it can be difficult to obtain loans.

Installments and Interest

It’s common for departing partners to receive payments in installments. Expect to pay interest if you go this route.

New Partner/ Outside Investor

If you’re ok with another party having some control over the company, you can bring on a new partner or outside investor as well.

Alternative Funding

Most alternative funding solutions are gap-fillers rather than total financing for the business buyout. For example, you can work with an invoice factoring company to accelerate payment on your B2B invoices. This may get you some or all the cash you need for your buyout or at least enough for an initial payment. You can use factoring to keep up with your installments during slow periods as well.

7. Negotiate the Terms of the Deal and Make Sure You Have All the Necessary Paperwork

The final step is to work out all the terms of your buyout deal. It should include details such as the partner’s equity stake, how payment will be made, and the exit timeline. Your attorney should be the one to draw up the contract, as they’ll address things you might overlook, such as non-compete agreements and whether the company needs to be legally restructured.

Alternatives to Partner Buyouts

You still have some options if you can’t agree to buyout terms.

- Change the weighting. Let’s say you’re 50/50 partners in every possible way now. You’re both equally liable, split profits evenly, and share decision-making power. You can reduce this to a 25/75 split, move one partner into a silent partner role, or divide things up in whatever way makes the most sense for you.

- Walk. Partners generally have the legal right to file disassociation paperwork at any time. That means you’ll leave the company, and your partner will have to buy you out.

- Dissolve the partnership. This may only be an option if it was included in your partnership agreement or if a court determines it’s the only path forward.

Boost Working Capital with Invoice Factoring

Whether you need a cash injection to help cover your buyout or want to start moving on it but need funds for attorneys and accountants, invoice factoring can help. Request a complimentary Charter Capital rate quote to get started.