“When the winds of change blow, some people build walls, and others build windmills.” This ancient Chinese proverb rings true even today. However, one question lingers: is your business preparing to build walls or windmills? If you’re fostering a culture of innovation, you’re far more likely to build windmills or perhaps something even more imaginative and beneficial. We’ll walk you through how to do this and why it matters below.

What is a Culture of Innovation?

The term “culture of innovation” refers to an organizational environment that consistently encourages and supports the creation of new ideas, processes, and solutions. It’s marked by a proactive approach to embracing change and leveraging creativity to achieve competitive advantages.

Traits of an Innovation Culture

Businesses that foster a culture of innovation share several key characteristics, as highlighted below.

- Openness: There’s an openness to new ideas and approaches, where employees feel valued and empowered to share their thoughts without fear of criticism.

- Collaboration: Teamwork and cross-departmental collaboration are encouraged, allowing for a blend of different perspectives and expertise.

- Experimentation: The organization supports taking calculated risks. Experimentation is seen as an essential duty, with the understanding that not every attempt will succeed, but each is a learning opportunity.

- Adaptability: Flexibility in processes and mindsets ensures the organization can pivot quickly in response to changes in the market or new information.

- Supportive Leadership: Leaders promote and actively participate in innovation activities. They set a tone that permeates through all levels of the organization.

How to Create an Innovation Culture: Steps to Inspire and Execute

Creating a culture of innovation requires intentional steps to foster an environment that encourages creative thinking and continuous improvement. First, it’s crucial to invest in innovation by providing the resources they need and establishing innovation labs where new ideas can flourish. Leaders must approach innovation not just as a side project but as the lifeblood of the organization, integrating it into their strategic plans and daily operations. For effective innovation, create a culture that values open communication and psychological safety. This makes it safe for employees to challenge the status quo and propose new ideas without fear of repercussion. Encourage departments to work as cross-functional teams, enhancing the diversity of thoughts and solutions. Lastly, recognize and reward innovation efforts consistently to maintain motivation and commitment to driving growth. This multifaceted approach ensures that innovation thrives, helping your company stay ahead of the competition.

Why Fostering a Culture of Innovation is Essential

Before we dig into how to foster a culture of innovation, let’s take a quick look at why it belongs in business growth strategies today.

Competitive Advantage

Innovation can differentiate a company from competitors. By continuously introducing new products, services, or processes, a company can maintain a leading edge in the market.

Adaptability and Survival

Markets, consumer preferences, and technologies are constantly evolving. An innovative culture prepares businesses to adapt to these changes to ensure long-term survival and growth.

Attracting and Retaining Talent

A culture that values creativity and personal input attracts dynamic and forward-thinking employees. By focusing on culture and helping people feel engaged and valued for their contributions, businesses can increase retention rates.

Increased Productivity and Efficiency

Innovative practices can streamline operations and reduce costs. Automation and improved processes, for instance, free up employee time for higher-value tasks and enhance productivity.

Customer Satisfaction and Loyalty

By innovating in response to customer feedback and anticipating market needs, businesses can enhance customer satisfaction. A strong focus on innovation can lead to improvements in products and services that boost customer satisfaction and increase loyalty.

Revenue Growth

Innovation can open new markets and revenue streams. Companies that innovate tend to grow faster than their counterparts.

The Role of Leadership in Fostering an Innovation Culture

Leadership plays a pivotal role in fostering an innovation culture within an organization. Effective leaders create an environment that encourages creativity by demonstrating their own commitment to innovation. This involves openly supporting experimentation, advocating for new ideas, and providing the necessary resources to explore these ideas. Leaders should establish a culture of psychological safety—a safe space where employees feel confident to take risks and express unconventional ideas without fear of failure. Additionally, by cultivating a culture that supports continuous improvement and encourages challenging the status quo, leaders can drive innovation efforts forward. To truly foster an innovation culture, leaders need to not only talk about innovation but also embed it into the organization’s DNA through clear innovation goals and regular evaluations of progress.

5 Proven Techniques for Fostering a Culture of Innovation

Now that we’ve covered the background, let’s take a look at specific strategies that can help foster a culture of innovation.

Experimentation and Innovation: How Taking Risks Leads to Success

Innovation often hinges on the organization’s willingness to take risks and embrace failure as a part of the growth process. Creating a safe space for experimentation within a company allows employees to test out their ideas without the pressure of immediate success. This environment encourages a culture of innovation that drives creative solutions and can lead to significant breakthroughs. Organizations must foster an environment that supports creativity and experimentation, where innovation is not stifled by the fear of failure. Emphasizing the need to create a culture of continuous improvement, businesses should encourage their teams to experiment with new processes, products, and business models. This approach not only cultivates a strong innovation culture but also ensures that innovation efforts are sustained and effective, helping businesses to stay ahead of industry curves and competition.

1. Encourage Open Communication

By encouraging open communication, businesses can develop a supportive environment that promotes the flow of ideas, enhances collaboration, and drives innovation. A few ways to address this are covered below.

- Flat Hierarchies: Reduce layers of management to make it easier for employees at all levels to share ideas directly with decision-makers.

- Regular Feedback Loops: Establish mechanisms like regular meetings, suggestion boxes, and digital forums where ideas can be shared and discussed openly across the organization.

- Transparent Communication: Leaders should communicate openly about company goals, challenges, and the value of innovation. Transparency builds trust and encourages employees to share ideas without fear.

- Active Listening Practices: Train managers and team leaders in active listening techniques so that they truly hear and consider employee suggestions and concerns.

- Cross-Departmental Collaboration: Organize mixed-team projects and cross-functional workshops that encourage employees from different areas of the business to exchange ideas.

- Recognize and Reward Contributions: Publicly acknowledge and reward innovative ideas and the efforts behind them, whether they succeed or not. This motivates the team and sends a signal that their contributions will be valued.

2. Foster Diversity and Inclusion

Fostering diversity and inclusion (D&I) is crucial for innovation as it brings varied perspectives that can lead to creative solutions and breakthroughs.

- Recruitment Practices: Adopt inclusive hiring practices and recruitment strategies that bring in diverse talent from various backgrounds, cultures, and experiences. This might include reaching out to different communities, using diverse hiring panels, and implementing an unbiased screening process.

- Inclusive Policies and Training: Develop and enforce policies that promote an inclusive workplace. Provide training that enhances the awareness of unconscious biases, cultural competence, and the benefits of a diverse working environment.

- Support Networks and Employee Resource Groups (ERGs): Establish networks or groups that support underrepresented employees to provide them with mentoring, networking, or support opportunities.

- Diverse Leadership: Encourage diversity in leadership positions, as this provides varied insights for strategic decision-making and sets an inclusive tone at the top.

- Regular Review of Practices: Continuously evaluate and adjust workplace practices and policies to ensure they support inclusion and enable all employees to feel valued and empowered to share their ideas.

Inclusive Innovation: How Diversity Enriches an Innovation Culture

A robust innovation culture thrives on diversity and inclusion. By creating an environment that fosters a wide range of perspectives, organizations can enhance their innovation efforts and drive substantial growth. Diversity in the workplace encourages creative thinking and helps to challenge the status quo, making it a critical factor in successful corporate innovation. Leaders should strive to build a culture that includes cross-functional teams composed of individuals from various backgrounds and disciplines. This diversity stimulates open innovation and supports a broader range of ideas and insights, enriching the organization’s innovation portfolio. Moreover, a culture of innovation fosters creativity and experimentation, making it essential to also foster an environment that values and protects these diverse contributions to nurture a strong innovation culture.

3. Support Risk-Taking

Supporting risk-taking is all about encouraging employees to step outside their comfort zone and explore new ideas.

- Safe-to-Fail Environment: Communicate that failures are an acceptable and valuable part of the innovation process. Emphasize learning from mistakes rather than penalizing them.

- Resources for Experimentation: Allocate specific resources, such as time, budget, and tools, for employees to experiment with new ideas. For instance, Google’s famous 20 percent rule gives employees one day a week to work on side projects. This led to the development of programs like AdSense and Google News, as CNBC reports.

- Stage-Gate Process: Use a stage-gate process to develop new ideas. This allows for small-scale testing and validation of ideas in controlled stages, reducing the overall risk before full-scale implementation.

- Fast Failing: Promote a culture where quick trials are preferred. This approach helps identify viability early and adjust plans without significant resource expenditure.

- Calculated Risk-Taking Rewards: Recognize and reward employees who take intelligent risks, even if the outcomes aren’t always successful. This can be through formal recognition programs, incentives, or through highlighting efforts in company communications.

4. Provide Continuous Learning Opportunities

Ongoing education keeps skills fresh and introduces new perspectives, which are critical to innovation.

- Training Programs: Offer regular training programs that cover the latest industry trends, technologies, and creative problem-solving techniques.

- Online Learning Subscriptions: Provide access to online learning platforms like Coursera, Udemy, or LinkedIn Learning, where employees can pursue courses relevant to their roles and interests.

- Encourage Conference Attendance: Sponsor employees to attend industry conferences and workshops. These events are great for gaining insights into cutting-edge practices and networking with innovators.

- Mentorship Programs: Establish mentorship programs that pair less experienced employees with seasoned professionals. This facilitates skill transfer and encourages a free flow of ideas.

5. Integrate Customer Feedback

By proactively seeking and integrating customer feedback, businesses can ensure that their innovations are relevant and effectively meet the evolving needs of their market.

- Regular Surveys and Polls: Conduct regular surveys and polls to gather feedback from customers on current products, services, and potential new offerings.

- Customer Feedback Panels: Establish a panel of customers who can provide ongoing feedback on new concepts and existing offerings.

- Social Media Engagement: Use social media platforms to listen to customer opinions and engage directly with them.

- Customer-Involved Beta Testing: Invite customers to participate in beta testing of new products or services.

- Feedback Integration in Product Development: Ensure that there is a structured process to analyze customer feedback and integrate it into product development cycles.

Sustaining Innovation Culture: Challenges and Solutions

Maintaining a culture of innovation presents its own set of challenges, primarily how to keep the momentum and ensure that innovation efforts lead to real outcomes. To sustain an innovation culture, organizations need to continuously invest in innovation resources and foster an environment that encourages creativity and growth. Establishing innovation labs and providing continuous learning opportunities are excellent ways to keep the innovative spirit alive. Moreover, creating a safe space for employees to express ideas and experiment can help maintain a culture of continuous improvement. To avoid stagnation, it’s crucial for organizations to regularly update their innovation strategies and adapt to new market trends and technologies. Recognizing and rewarding innovation not only motivates employees but also reinforces the company’s commitment to fostering an innovation culture. By addressing these challenges head-on, organizations can ensure that their innovation culture remains vibrant and effective, driving long-term success and competitiveness in the market.

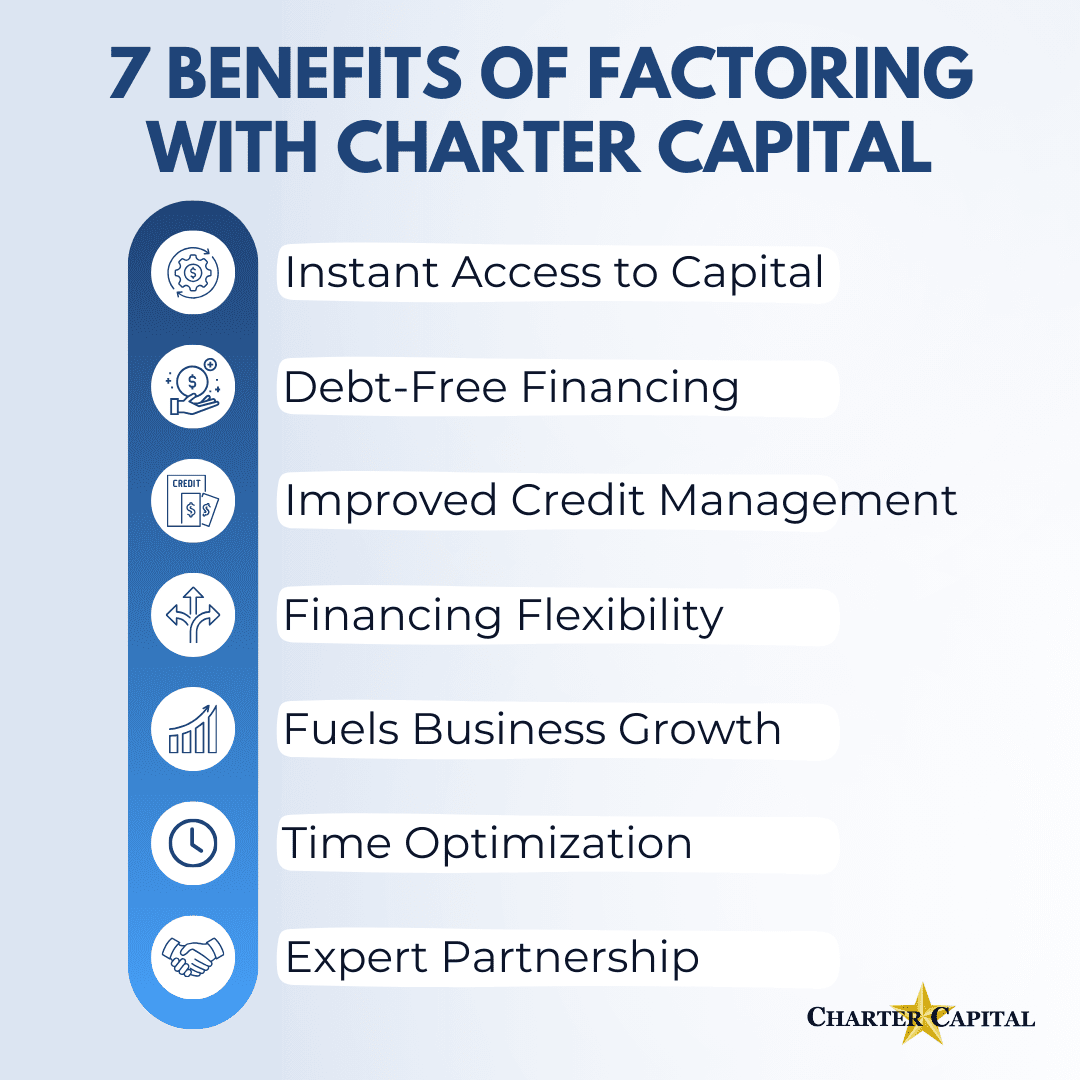

Equip Your Business to Foster a Culture of Innovation with Factoring

While most of the strategies outlined here are not resource-intensive, fostering a culture of innovation and seizing opportunities brought on by this culture can sometimes require a quick injection of working capital. Invoice factoring provides this by accelerating payment on your B2B invoices. Your customer clears the balance when they pay their invoice, so there’s no debt to pay back, and your business is free to focus on the future. If factoring sounds like your ideal working capital solution, request a complimentary rate quote.