As your business growth opportunities rise, managing vendor payments can often become a time-consuming and complicated task. This puts unnecessary strain on you, your business, and on supplier relationships, but it’s easier to fix than you might think.

On this page, we’ll explore what can go wrong in the vendor payment process, plus explore some best practices in vendor management that you can start applying right away to make life easier for everyone.

Common Vendor Payment Issues

When vendor payment management is lacking, you’ll start to notice some or all the signs below.

Late Payments

Nearly three-quarters of procurement professionals say late payments strain business relationships per PYMNTS surveys. Yet, more than 40 percent of businesses report having a late payment fee in the past year, other PYMNTS surveys show. This is one of the more obvious signs your vendor payment management strategy is lacking, but it’s often dismissed as a one-time oversight and goes unaddressed.

A Lack of Visibility into Supplier Spending

It’s often difficult to keep track of expenses in today’s subscription-based society. At home, you might sign up for three different streaming services, then forget you have them. The same thing happens at work, but it’s amplified. It’s not just you setting up auto-charges. It’s multiple people across multiple cards. Sometimes businesses pay for multiple subscriptions to the same service or place the same order twice just because there’s no visibility or bird’s-eye view of what’s happening.

Manual Invoice Approval Processes

Many businesses don’t see manual approval processes as being a vendor payment issue. However, it’s one of the top reasons businesses report late vendor payments, according to PYMNTS. Between the lack of efficiency and entry errors, manual approval processes can cause many vendor-related issues.

Security Issues

It can take a considerable amount of time to recover after a security breach, and you may not be able to pay suppliers in the interim. You may have security issues if you’re:

- Mailing payments

- Making payments through unencrypted portals

- Failing to take steps to protect cards and account numbers

9 Tips to Improve Your Vendor Payment Process

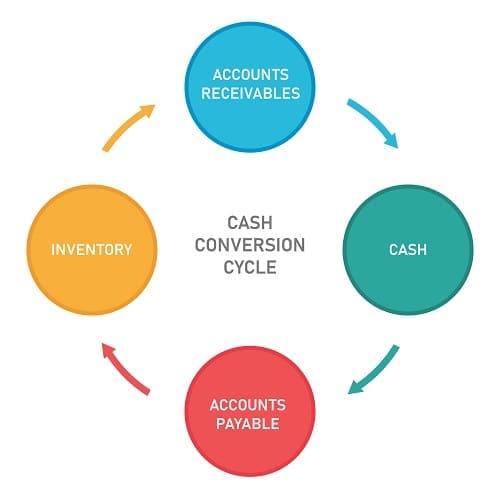

When you manage vendor payments effectively, you’ll keep more money in your business, have better cash flow, and have better relationships with your suppliers. Apply these nine tips and start improving your vendor payment strategy right away.

1. Automate Your Invoice Processes with Vendor Payment Software

Accounts payable (AP) automation addresses some of the most common vendor payment issues. It helps ensure you don’t lose track of payables, boosts efficiency, and can help you save money in the long run.

2. Track All Your Due Payments

You should have a good idea of what’s coming due even before you receive an invoice. Good accounting software will allow you to add purchase orders to the system and help you predict what needs to be paid and when it needs to be paid.

3. Prioritize Paying Your Vendors Early

Paying on time is crucial to maintaining strong vendor relationships. Because these relationships can determine everything from who receives supplies in a crunch to pricing, timely payments are essential for the health of your business too.

With that said, sometimes vendors incentivize early payments. Try to get payments out within the specified window to not only delight your vendors with rapid payments but also to keep more money in your pocket.

4. Centralize Your Invoice Payments with a Vendor Payment System

Sometimes AP software is fairly basic and only allows you to track what’s due and what’s been paid based on invoices you’ve received. That’s not nearly enough if you have multiple team members with credit cards or different departments paying their own bills with no general oversight. That’s how companies wind up hemorrhaging money by having duplicate subscriptions and subscriptions to tools nobody uses anymore. Ensure there’s enough transparency so that you can see what each credit card transaction is.

5. Set and Implement a Clear Vendor Management Policy

A strong vendor management policy helps your business minimize risk, ensure continuity, and maintain better relationships with your suppliers. As a start, your vendor management policy should include:

- How your business sources vendors

- Policies for contract negotiations

- How vendors are onboarded

- Policies for setting service-level agreements (SLAs) and penalties for failure to meet them

- Vendor risk management procedures

- Payment policies

6. Ensure Invoice Accuracy

American businesses lose an average of $300,000 per year due to fraudulent invoices, according to Medius research. Moreover, around a quarter of finance professionals can’t estimate the cost of invoice fraud to their business. Each invoice you have should be matched up to a purchase order prior to payment. That way, you catch any legitimate fraud and don’t wind up paying for genuine errors or unintentional duplicate bills either.

7. Accept Accountability Where Necessary

If you’re not making timely payments or are having other vendor payment issues, it’s important to own up to your mistakes and let the vendor know you’re taking steps to correct the problems. You don’t necessarily need to tell them what happened or why—sharing too much financial info increases your risk—but at least letting them know you take the matter seriously can help maintain the relationship despite issues.

8. Conduct Regular Audits

Audits are typically performed on an annual basis by a third party who looks at your:

- Balance Sheet

- Purchase Orders

- Check Register

- Supplier Invoices

- General Ledger

The goal is to confirm the completeness, accuracy, and validity of your records. If you’re not ready to bring in an external auditor just yet, perform your own and ensure everything matches up.

9. Make Sure You Always Have Capital for Vendor Payments

Sometimes, businesses make cash flow mistakes or simply experience a period of rapid growth that leaves them short on cash. Your vendor payments should still be prioritized. Explore options to increase working capital.

Get Ahead of Cash Flow Issues with Invoice Factoring

If you’re unable to make vendor payments on time due to cash flow issues, invoice factoring from Charter Capital can help. We accelerate payment on B2B invoices on an as-needed basis, so your business can maintain strong vendor relationships, avoid late fees, and operate at its best. To learn more or get started, request a complimentary factoring quote.