As a small-business owner, you’re probably keenly aware of the cash conversion cycle (CCC), even if it’s not something you’re intentionally measuring or monitoring. It’s a measure of business health and, when you’re nailing it, you’ve generally got solid cash flows and plenty of money in the bank. You’re not worried about how you’ll pay your vendors or payroll. When your CCC isn’t working in your favor, money is tight, and no amount of business growth can fix it. You’ll always be under pressure to find hidden cash and struggling to make ends meet.

But, what is it about CCC that makes it so powerful, and how can you make it work in your favor? We’ll give you the cash conversion cycle formula, insights on what your numbers mean, and ways to improve your situation below.

What is the Cash Conversion Cycle & How Can it Help Me?

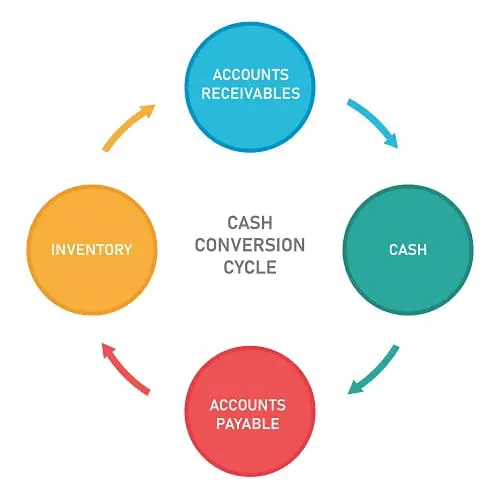

Also known as a net operating cycle, your CCC is calculated using several activity ratios, including those related to accounts payable, accounts receivable, and inventory turnover. You can think of CCC as the period between making an investment, usually through the purchase of inventory, and getting the return on your investment, usually through final payment from a customer after delivering a product or service. The shorter the span, the faster you’re generating cash. The longer the span, the slower you’re generating cash. Naturally, you want the length of time to be as short as possible to maximize cash on hand, but the data your CCC provides you with is far more telling than that. Although it should be incorporated with other metrics (such as return on assets (ROA) and return on equity (ROE) ), the CCC can provide valuable insights by comparing close industry competitors.

The CCC Helps Measure the Health of Your Business

A typical cycle may look something like this:

Order and pay for raw materials >> Convert materials into a sellable product >> Sell the product >> Collect from the customer.

As you know, the longer any of those stages takes, the tighter things get. You may not be able to order or pay for more raw materials because you’re still stuck waiting on payment from the customer.

That’s the vicious cycle most small businesses and startups face. It doesn’t matter whether you’re investing $50,000 in the first step or a million. You’re always going to be stuck in limbo to the same degree if you don’t find a way to get your raw materials without paying for them right away or get your customers to pay faster. That’s why growth won’t fix a cash cycle problem and why CCC is a key indicator of your overall health.

It’s worth noting, however, that looking at CCC by itself for a single period doesn’t give you the whole picture. You’ll want to see how your CCC is trending over time and use additional metrics to gauge your overall success too.

You Can Evaluate Management Strength with the CCC

Many metrics, and even intangible factors, can be used to gauge the strength of a company’s management. The CCC is one of the top options. As you can see from the earlier example, a company that isn’t converting an investment into cash swiftly is always going to need outside money to grow or bridge gaps. However, when management finds ways to speed up the CCC, cash on hand builds.

You Can Compare Your Business Against Competitors with CCC

When investors are choosing between two similar companies or lenders are on the fence, they’ll usually look at the CCC as well. Simply put, the company that turns an investment into cash faster will go places long before the sluggish one does.

Understanding the Different Elements of the CCC Calculation

Now that you have a better background in how the CCC works and what it means to your business, let’s go over how to calculate your CCC. You’ll need access to company figures over a period of time, such as a quarter or year.

Figures to gather include:

- Revenue

- Beginning Inventory Value

- Inventory Purchases

- Ending Inventory Value

- Beginning Accounts Payable Value

- Ending Accounts Payable Value

- Beginning Accounts Receivable Value

- Ending Accounts Receivable Value

With these in hand, you’ll be able to work out the three elements of your CCC.

Sample Figures

As we break down CCC calculations in the coming sections, we’ll be working with the following sample figures of a mock company’s most recent year.

- Revenue: $75,000,000

- Beginning Inventory Value: $3,000,000

- Inventory Purchases: $40,000,000

- Ending Inventory Value: $8,000,000

- Beginning Accounts Payable Value: $7,000,000

- Ending Accounts Payable Value: $9,000,000

- Beginning Accounts Receivable Value: $7,000,000

- Ending Accounts Receivable Value: $10,000,000

Days Inventory Outstanding (DIO)

The first part of the CCC calculation is DIO—the average length of time it takes you to convert inventory into goods and then sell them.

Formulas you’ll need to include:

Average Inventory: (Beginning Inventory + Ending Inventory) / 2

Cost of Goods Sold: Beginning Inventory + Purchases – Ending Inventory

DIO: (Average Inventory / Cost of Goods Sold) x Number of Days in Period

Sample DIO Calculation

Average Inventory: ($3,000,000 + $8,000,000) / 2 = $5,500,500

Cost of Goods Sold: $3,000,000 + $40,000,000 – $8,000,000 = $35,000,000

DIO: ($5,500,500 / $35,000,000) x 365 = 57 days

In this example, it takes our mock company 57 days to turn their inventory into goods and sell them.

Days Sales Outstanding (DSO)

The second part of the CCC calculation is DSO—the average length of time it takes to collect.

Formulas you’ll need to include:

Average Accounts Receivable: (Beginning Accounts Receivable + Ending Accounts Receivable) / 2

Revenue per Day: Revenue / Number of Days in Period

DSO: Average Accounts Receivable / Revenue Per Day

Sample DSO Calculation

Average Accounts Receivable: ($7,000,000 + $10,000,000) / 2 = $8,500,000

Revenue per Day: $75,000,000 / 365 = $205,479

DSO: ($8,500,000 / $205,479) = 41 days

In this example, it takes our mock company an average of 41 days to collect.

Days Payable Outstanding (DPO)

The third and final part of the CCC calculation is DPO—the average length of time it takes you to pay your accounts payable (pay your vendors after you’ve purchased inventory).

Formulas you’ll need to include:

Average Accounts Payable: (Beginning Accounts Payable + Ending Accounts Payable) / 2

Cost of Goods Sold: Beginning Inventory + Purchases – Ending Inventory

DPO: (Average Accounts Payable / Cost of Goods Sold) x Days in Period

Note: While we’re working with the above in this example, an alternate formula you can try is: Days Payable Outstanding = Average Accounts Payable / (Cost of Sales / Number of Days in Accounting Period)

Sample DPO Calculation

Average Accounts Payable: ($7,000,000 + $9,000,000) / 2 = $8,000,000

Cost of Goods Sold: $3,000,000 + $40,000,000 – $8,000,000 = $35,000,000

DPO: ($8,000,000 / $35,000,000) x 365 = 83 days

In this example, our mock company waits 83 days to pay its bills.

The Cash Conversion Cycle Formula

Now we’re ready to calculate the cash conversion cycle.

DIO + DSO – DPO = Cash Conversion Cycle

Because DIO and DSO relate to a company’s cash inflows, they’re reflected as additions, while DPO, the only cash outflow, is subtracted.

Sample DPO Calculation

Going back to our earlier calculations, our mock company’s CCC equation is:

57 + 41 – 83 = 15

It takes this company 15 days from the time it purchases inventory to collect on it.

“Good” vs. “Bad” CCC

Over the past decade, S&P 1500 company CCC averages have climbed from about 64 to 71 days just before the pandemic per JP Morgan. Meanwhile, Goliaths like Walmart have CCCs under ten days, and Amazon manages to pull off a negative cash conversion cycle, according to Forbes. Each industry, and each company, will have unique benchmarks. Your company may not be able to whittle down your CCC to match Walmart or Amazon, but you should be actively working to improve yours and keep it as reasonably low as possible.

How to Improve Your Cash Conversion Cycle

Need to make a change? There are three high-impact areas you can focus on if you want to reduce your CCC.

Reduce Accounts Payable

Payables can be addressed in two big ways. First, eliminate any account you don’t genuinely need and cut back expenses as much as possible. Secondly, connect with the suppliers you plan to keep working with and see if they’re willing to extend credit or lengthen your terms on any outstanding payments. The more days payables sit, the more you can put your money to work for you.

Boost Accounts Receivable

Explore ways to get your customers to pay faster. Changing your invoicing terms, offering rewards for early payment or pre-payment on an account receivable, and factoring your unpaid B2B invoices can help.

Reduce Inventory

Keeping inventory days on end without use is a major CCC killer. You probably won’t get what your inventory is worth through liquidation, so it’s better to hold off on restocking until you absolutely need to order and focus on keeping minimal inventory on hand instead.

Improve Your CCC with Factoring

If your business needs to speed up payments and free working capital, you can sell your unpaid B2B invoices to a factoring company and get cash in hand in as little as a day. Get started with a complimentary quote from Charter Capital.

- 6 Types of Business Insurance You Can’t Afford to Ignore - July 22, 2024

- Handling Payment Delays as a Government Contractor - June 24, 2024

- Quick Guide: Invoice Factoring for Security Companies - May 27, 2024