More than two-thirds of small businesses are leveraging artificial intelligence (AI) solutions, according to the latest Small Business AI Adoption survey. However, adoption rates are lower among those with lesser revenue. This is an unfortunate catch-22, as those with reduced revenue often hold off on investing in AI solutions due to cash constraints, which in turn hinders growth and profitability, leaving the business stuck and unable to scale.

Because of this, it’s not really a question as to whether your business can afford AI solutions. The odds are that you can’t afford not to implement them. But knowing this doesn’t necessarily make it easier to select the right tools or find the cash to implement them. That’s what we’ll do here. Below, we’ll explore how AI solutions can benefit your business, what type of return on investment (ROI) you can expect from various tools, and how to begin including AI in your business operations in a cost-effective way.

AI Benefits for Small Businesses

Before we get into the costs associated with AI solutions, let’s take a quick look at some of the ways small businesses benefit from implementing them.

Time Savings

Time savings is one of the biggest reasons small businesses turn to AI solutions, and it tends to pay off. For instance, a typical small business owner saves 13 hours per week on their own tasks with AI, plus manages to shave another 13 hours off employee hours, per the Small Business AI Adoption survey.

Not surprisingly, most choose to reinvest these savings back into their companies. For example, just over 40 percent apply the time to higher-value work.

Improved Decision-Making

AI can process vast amounts of data quickly and provide actionable insights. Because of this, many small businesses find it invaluable for tasks like forecasting demand or cash flow and analyzing customer behavior.

This, of course, has other implications. More than half of executives say it has increased their productivity, according to Forbes. Meanwhile, supply chain errors reduce between 20 and 50 percent with AI. This leads to more efficient use of capital and allows businesses to meet customer demands with greater ease.

Cost Savings

The median annual savings for businesses that implement AI solutions is $7,500, per the Small Business AI Adoption survey. A quarter say their annual savings exceed $20,000. Roughly two in five small businesses say they reinvest this into their business by purchasing new equipment and technology, while others pursue growth opportunities, build emergency funds, pay down debt, and more.

3 Ways Small Businesses Use AI Solutions

Now that we’ve covered the key benefits, let’s take a quick look at how businesses are applying AI technology in their everyday work.

1. Business Process Automation

Business process automation (BPA) is one of the easiest and most cost-effective ways small businesses can tap into AI solutions. Think of it as using AI to handle routine tasks so you and your team can focus on growth, strategy, and serving your customers.

For instance, you might automate administrative tasks, like scheduling and payment processes, or leverage it to manage your supply chain.

2. Improving Customer Experiences

By leveraging AI, you can anticipate customer needs, respond faster, and personalize interactions more effectively and efficiently. These things lead to improved customer experiences, which directly translates to greater loyalty and increased sales.

For instance, many small businesses leverage AI in customer service by integrating chatbots and other self-help tools or by triaging and streamlining customer service queues.

3. Enhancing and Expanding Marketing and Sales

Monumental gains can be seen by incorporating AI in marketing and sales functions because it can be leveraged every step of the way. For instance, your digital marketing team might use targeted advertising to reach the people who are most likely to convert and match them with a message that’s likely to resonate with them. Once the person expresses interest via an online form, their data then flows freely into a customer relationship management (CRM) platform where they’re assigned a score based on their readiness to buy and automatically assigned to an agent. In the background, they begin seeing content that’s tailored to their needs on the website and receiving personalized emails that help overcome their objections and take the next step. This is only the tip of the iceberg, but it has a tremendous impact on the number of sales a team closes and the level of effort that goes into each sale.

AI Costs and ROI Explained

Investing in AI might seem a little intimidating at first, but the cost-to-benefit ratio makes it an easy choice. Understanding the costs, potential ROI, and how to start small can help you make a confident decision.

How Much Does AI Cost?

It might help to know that a typical small business spends just $1,800 a year on AI, according to the Small Business AI Adoption survey. It can be quite affordable, depending on the type of investments you choose to make. Let’s take a quick look at some of the common price points.

Free and Affordable AI for Small Businesses

Many platforms integrate AI features into their basic plans. For instance, the design program Canva has a free option that includes access to its AI art generator. For content creation, there’s ChatGPT. It’s also free to use.

Subscription-Based AI Tools For Small Businesses

Platforms like Canva and ChatGPT that start free often transition into low-cost monthly subscriptions. Once you move into this bracket, you have even more options. For instance, QuickBooks accounting software includes AI features and costs less than $40 per month. They often offer a free trial and other perks to make getting started more affordable. Meanwhile, brands looking for more robust solutions relating to marketing, sales, service, and more can leverage HubSpot as a subscription-based model. While it also starts free, the options with AI enhancements start to kick in at around $50 per month.

It’s worth noting that many of these subscription-based AI solutions charge by the “seat” and may tack on extra charges for each feature, so it’s important to carefully evaluate the tool and your exact needs before signing up.

Custom AI Solutions

If your business has unique needs, you can invest in custom development of an AI tool. Systems tend to start at around $5,000 but can rise to $50,000 or more depending on the complexity, so they tend to be more common for midsized businesses and those in unique niches.

Calculating AI ROI

It’s important to consider the ROI of AI because, even though there are upfront costs associated with implementation, many AI solutions pay for themselves and increase profitability. When performing a cost-benefit analysis, be sure to include the factors outlined below in your calculations.

Time Savings

Each AI solution is different. Identify specific tasks your tool will automate and how much time you’ll save by not manually completing those tasks. Then, multiply the hours by the hourly rate of the person performing the task.

If you’re unable to calculate accurate time savings, work with estimates. Again, a typical small business owner saves around 30 hours per week between themselves and employees. The average business leverages four AI tools, meaning a typical AI solution will save a small business 7.5 hours per week.

Increased Revenue

Businesses boost revenue by implementing AI solutions across a wide variety of business functions, as McKinsey reports. For instance, 80 percent of those who leverage AI for marketing and sales see a revenue boost, with 40 percent seeing gains of six percent or more. Those implementing AI in product and service development see similar gains. While typically more modest, more than half of all businesses see revenue increases when they implement AI solutions in areas like supply chain management, manufacturing, service operations, strategy and finance, risk, and HR.

Cost Reduction

Major cost reductions are also seen across a wide variety of areas, depending on how AI solutions are implemented. For instance, manufacturing and supply chain management are standouts for most businesses, with 64 and 61 percent of businesses reporting cost reductions, respectively. More than a quarter say they’re able to cut costs by at least ten percent.

Scalability

It’s also worth noting that implementing AI solutions often allows businesses to help more customers or manage larger volumes of work without increasing their headcounts.

AI Cost Breakdown: Understanding Expenses for Small Businesses

For small businesses, understanding AI costs goes beyond general pricing. The expenses depend on the type of AI system, the complexity of the application, and the intended use case. While simpler AI projects, like chatbots or automated scheduling tools, involve minimal costs, advanced systems such as generative AI or predictive analytics require higher investment.

Generative AI Tools as a Cost-Effective Entry Point

Generative AI platforms, like ChatGPT or DALL·E, provide pre-built AI capabilities that drastically lower the cost of implementation. These tools require no custom development and offer flexible subscription tiers, making them an ideal starting point for small businesses looking to explore AI without significant upfront costs.

Pre-Trained Models vs. Custom AI Development

Businesses across industries can save significantly by using pre-trained machine learning models instead of building custom AI from scratch. For example:

- Pre-Trained Models: These models are ready for deployment, reducing costs associated with training AI algorithms. They are ideal for common use cases like data analysis or customer behavior prediction.

- Custom AI Development: This approach is necessary for unique needs but comes with a higher total cost. Businesses may need to allocate $5,000 to $50,000 or more, factoring in development, software licensing, and ongoing maintenance.

Factors That Influence AI Costs

When it comes to AI, several variables affect the overall cost, including:

- AI Capabilities: Advanced systems like generative AI or predictive analytics cost more due to higher computational and storage needs.

- Compliance Needs: Ensuring AI systems comply with industry regulations can increase development costs, especially in industries like healthcare or finance.

- Ongoing Costs: Maintenance, updates, and scaling often add recurring expenses that businesses must budget for.

Industry-Specific Cost Implications

AI pricing also varies by industry. For example:

- AI Marketing Tools: These often have lower upfront costs and provide scalable pricing, making them accessible for small businesses.

- Operational AI Systems: AI applications in logistics or manufacturing may involve higher hardware and integration costs but deliver significant ROI in efficiency and scalability.

By carefully evaluating the specific AI tools and services they need, businesses can prioritize high-ROI applications while managing costs effectively. Whether leveraging pre-trained models or exploring generative AI tools, small businesses can deploy AI solutions that fit their budgets and goals.

Quick Tips for Managing Costs During AI Implementation

With the long-term benefits and ROI businesses achieve through implementing AI solutions, the case for leveraging them is clear. However, many small businesses still put it off due to the upfront costs. Below, we’ll cover a few tips to help you navigate the transition.

1. Start Small and Scale Gradually

Don’t try to implement multiple new systems at once. Instead, identify a single pain point your business needs to solve, such as enhancing customer service or improving inventory management. Then, explore AI solutions that address it.

2. Leverage Free and Low-Cost Tools

Many AI-powered tools offer free tiers or affordable starter plans. Start with these to get a feel for how the tool impacts your workflows.

3. Prioritize Cloud-Based Solutions

Cloud-based AI platforms eliminate the need for expensive hardware or IT infrastructure upgrades. For instance, Google Workspace comes with Gemini to boost productivity and works on most systems, so there’s no upfront cost beyond the monthly fee.

4. Use Pay-as-You-Go Models

Whenever possible, choose AI tools that have flexible subscription models that allow you to scale usage and costs as your business grows. Many offer discounts for longer commitments, which can be an excellent choice after you’re confident the tool meets your needs.

5. Focus on ROI-Driven Use Cases

Choose AI tools that deliver measurable results, such as saving time, reducing errors, or increasing revenue. For most businesses, this means starting with marketing and sales tools, as they directly impact the sales pipeline.

6. Tap into Free Training and Resources

Many AI vendors offer courses, tutorials, webinars, and other support options to help you maximize the tool’s value without hiring experts. For instance, HubSpot has an entire library of free courses that help users navigate their products.

7. Monitor Usage and Adjust

Regularly assess how your team uses AI tools. If certain features go unused, consider downgrading to a more cost-effective plan. It may be helpful to assign a single person to track ROI and identify areas to optimize.

8. Combine AI Solutions with Existing Tools

Instead of replacing your current systems, find AI solutions that enhance them. For instance, you may be able to find AI add-ons for your current CRM or accounting software to keep costs down.

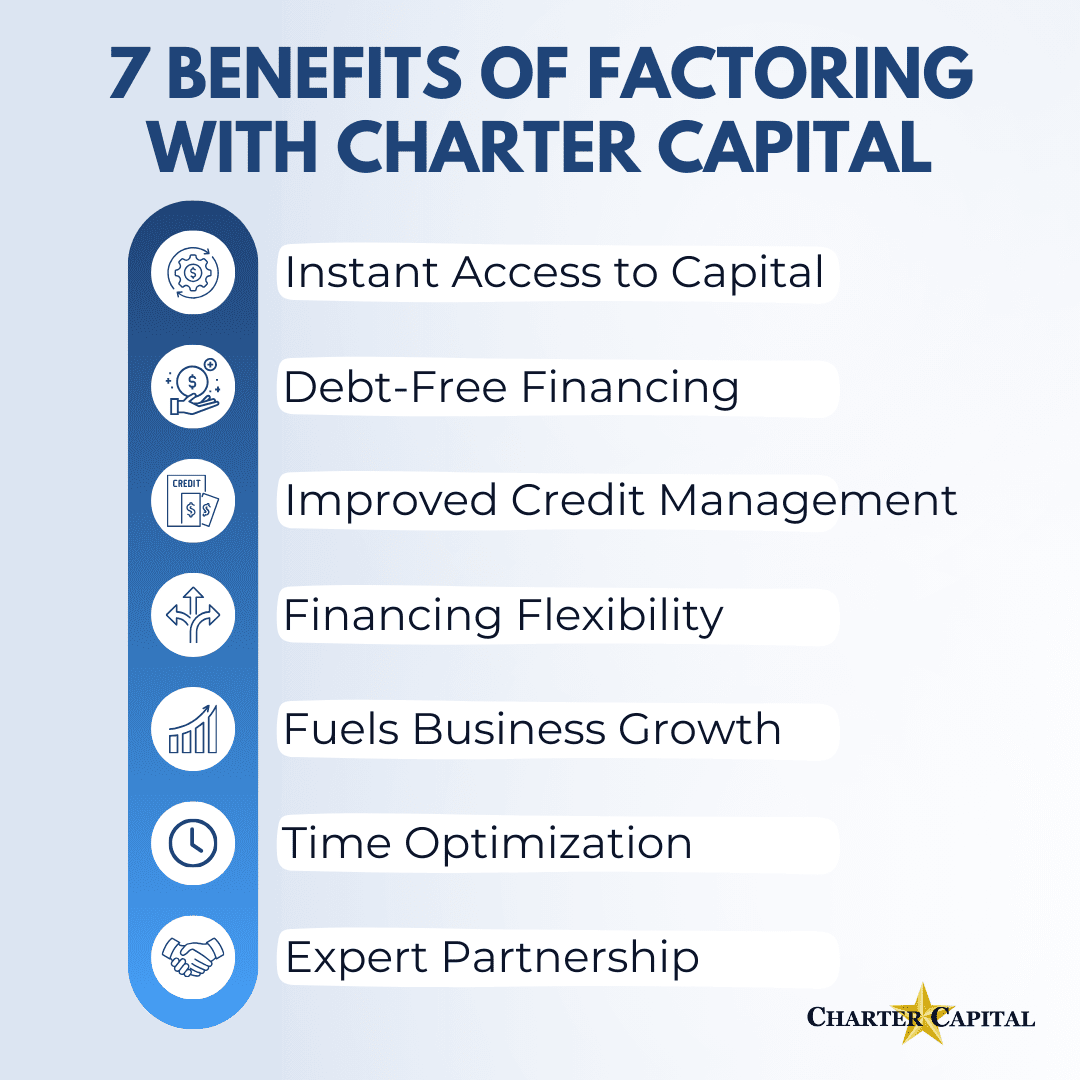

9. Use Invoice Factoring

If upfront costs are a concern, consider using factoring to free up cash. Factoring involves selling your unpaid B2B invoices to a factoring company like Charter Capital. You get most of the invoice’s value upfront and can apply the funds wherever they’ll do the most good for your business.

Kick Off Your AI-Driven Growth Plan with Help from Charter Capital

With decades of experience in the industry and competitive rates, Charter Capital makes it easy for businesses to obtain working capital for investments in AI solutions or everyday needs like covering payroll and seizing business opportunities. To learn more or get started, request a complimentary rate quote.