Why is invoice factoring important?

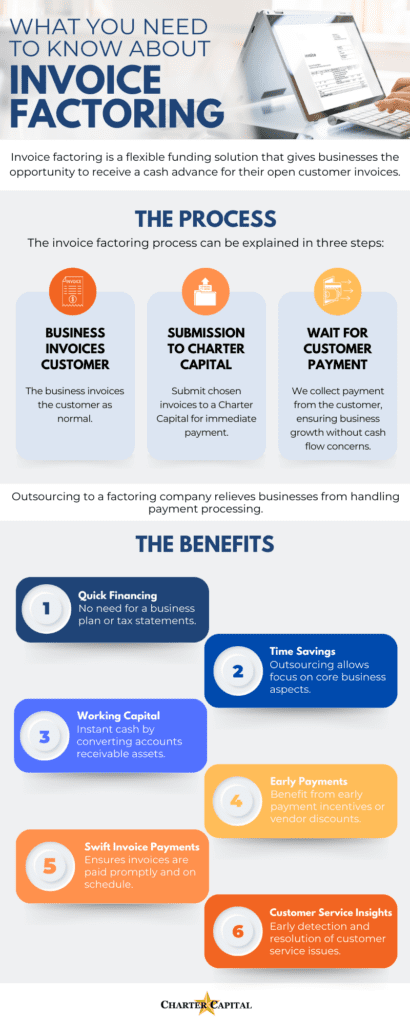

As a small business owner, focusing on your growing business should be your top priority. When you have to deal with collections and accounts receivable, this can distract you from what matters most. With small business invoice factoring, this inefficiency can be eliminated. Invoice factoring is a flexible funding solution that gives businesses the opportunity to receive a cash advance for their open customer invoices.

Enter small business invoice financing for managing business finances. Rather than relying on business credit to create working capital, factoring for small businesses involves an immediate upfront cash payment in exchange for the purchase of your accounts receivables. There is no business loan, no payments, and no debt incurred. You simply receive an upfront payment for the amount of your customer’s outstanding invoice value, minus a small factoring fee portion on the invoice amount. Your accounts receivables, i.e. business invoices, act as a kind of collateral for your financing option and reduce cash flow issues.

As a startup, you could turn to a traditional bank for a bank loan, but it likely would require stellar personal creditworthiness plus collateral, a physical asset such as real estate that the lender could sell if you default. Invoice factoring companies, on the other hand, offer much more flexible terms as a part of the factoring agreement. The approval process from an alternative lender like a factoring company is a lot easier, plus your business and personal credit score are not taken into account as much as your customers’ credit histories.

Charter Capital USA is here to let you know how simple and effective invoice factoring really is. It only takes three simple steps:

• The business invoices the customer as per normal.

• Next, the business submits unpaid invoices they want to a factoring company like Charter Capital.

• Finally, the factoring company waits for the invoice payment from the customer, so the business can continue to grow without worrying about cash flow to payroll and other expenses. The factoring company then collects the invoice when it’s due and, once all your clients have paid, reimburses you the remaining balance owed to you minus their factoring fee (also known as the discount rate).

Based in Houston, Texas, Charter Capital has been providing financial solutions to small businesses across the country since the late 1980s. We are here to make your life simpler by handling cash flow and invoicing issues so you can focus on more pressing business issues. Charter Capital works with multiple companies and provides factoring services to some of the following industries: trucking, staffing, security firms, wholesale, machine shops, and manufacturing. We do business with start-up companies as well since we focus on the financial conditions of clients’ customers instead of the client itself.

Though our headquarters is in Houston, we do business all over the U.S. Charter Capital’s major markets include: Dallas, San Antonio, Atlanta, Albuquerque, Phoenix, Nashville, Indianapolis, and Oklahoma City. If you are interested in our invoice factoring services for your small business, visit charcap.com to get a free quote or call us today toll-free at 1-877-960-1818.

- What Is An Invoice Factoring Broker? - July 17, 2022

- 7 Tips for Buying Out a Business Partner or Majority Owner - May 13, 2022

- 6 Leadership Secrets Every Small Business Owner Should Know - December 9, 2021